This learning module covers the investment characteristics of:

Private capital is a broad term for funding provided to companies that is not sourced from the public equity or debt markets.

Capital that is provided in the form of equity investments is called private equity, whereas capital that is provided as a loan or other form of debt is called private debt.

Private equity means investing in private companies or public companies with the intent to take them private. The companies in which the private equity funds invests are called portfolio companies because they will become part of the private equity fund portfolio.

The three main categories of private equity are:

Leveraged Buyouts

Leveraged buyout is an acquisition of an established public or private company with borrowed funds. If the target company is a public company, then after the acquisition, the company becomes private, i.e., the target company’s equity is no longer publicly traded.

The acquisition is significantly financed through debt, hence the name leveraged buyout. LBOs capital structure consists of equity, bank debt, and high-yield bonds. The firm (GP) puts in some money of its own, raises a certain amount from LPs, and a substantial amount of money is borrowed in the form of debt to invest in companies.

For example, assume the GP invests in a target company that requires an investment of $100 million. In this, the GP invests $20 million of its money (equity), $70 million from bank debt, and the remaining $10 million is raised by issuing high-yield bonds.

There are three changes that happen to a company as a result of a leveraged buyout:

Why LBO?

There are two types of LBOs:

Venture Capital

Venture capital firms invest in private companies (portfolio companies) with significant growth potential. The time horizon is typically long-term. The distinction between VC and LBO is that the latter invests in mature companies, whereas VC invests in growing companies with a good business plan and strong prospects for future growth.

Other important points related to VCs are given below:

Formative stage: Company is still being formed.

Later stage financing: For expansion after commercial production and sales but before IPO.

Mezzanine stage: Preparing to go public.

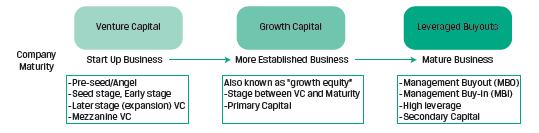

Exhibit 2 from the curriculum shows the growth stages of a company and the types of financing it may receive at each stage.

Exit Strategies

The goal of private equity is to improve new or underperforming businesses and exit them at high valuations. Typically, investments (target companies) are held for an average of 5 years. The holding period may be longer or shorter.

Common exit strategies are:

Private debt refers to various forms of debt provided by investors to private entities.

Key private debt strategies include:

Risk/Return of Private Equity

Private equity may provide higher return opportunities relative to traditional investments. Some of its benefits include the following:

However, the higher return is often associated with higher illiquidity and leverage risks.

Risk/Return of Private Debt

Private debt investments can provide a higher return as compared to traditional bonds. However, this higher return if often connected to higher levels of risk.

Investing in private capital can provide moderate diversification benefits because of their low correlation to stocks and bonds. Investors should identify and invest in the best performing private equity funds.

Real estate has two major sectors:

The key reasons for investing in real estate are:

A title or deed represents ownership of real estate property, including building and land-use rights, as well as air, mineral, and surface rights. Titles can be purchased, leased, sold, mortgaged, or transferred. A title search is an important part of buyer and lender due diligence because it ensures the seller/borrower owns the property free and clear of any liens or other claims against it, such as those from other owners, lenders, or investors, or from the government for unpaid taxes.

Investment characteristics of real estate are as follows:

Residential Property

Commercial Property

REITs

Mortgage-Backed Securities

Real estate investing can be categorized along two dimensions: public/private markets and debt/equity based. Exhibit 9 presents the four quadrants for the basic forms of real estate investments with examples:

Basic forms of real estate investments and examples

| Debt | Equity | |

| Private | • Mortgages

• Construction lending • Mezzanine debt |

• Direct ownership of real estate: ownership through sole ownership, joint ventures, separate accounts, or real estate limited partnerships

• Indirect ownership via real estate funds • Private REITs |

| Public | • MBS (residential and commercial)

• Collateralized mortgage obligations • Mortgage REITs • ETFs that own securitized mortgage debt |

• Shares in real estate operating and development corporations

• Listed REIT shares • Mutual funds • Index funds • ETFs |

Equity-based investments represent ownership of real estate properties. Ownership can be through sole ownership, joint ventures, real estate limited partnerships, etc. A variation of equity-based investments is leveraged ownership: Assume a building costs $10 million, and you put $3 million of your money and borrow $7 million. This is called leveraged ownership. That is, leveraged ownership is where a property is obtained through equity and mortgage financing.

If you are investing in a debt-based real estate investment, it means you are lending money to a purchaser of real estate. A classic example is a mortgage loan. This is considered a real estate investment because the value of the mortgage loan is related to the value of the underlying property.

There can be many variations within the basic forms:

The main advantage of the REIT structure is that it avoids double corporate taxation. Normal corporations pay taxes on income, and then the dividend paid from the after-tax earnings are taxed again at the shareholder’s personal tax rate. REITs can avoid corporate income taxes by distributing 90% – 100% of their rental income as dividends.

The value of the REIT shares is based on the dividend. REIT shares often trade publicly on exchanges. It is a way for individual investors to earn a share of the income from commercial properties (office buildings, warehouses, and shopping malls) without buying them. Risk and return of REITs vary based on the types of properties they invest in. Equity REITs invest primarily in residential and commercial properties.

Real Estate Indexes

There are a number of indexes to measure real estate returns that vary based on the underlying constituents and longevity.

Real Estate Investment Risks

Like any investment, real estate investing has its risks if the outcome does not turn out to be as per expectations.

Many investors prefer real estate for its ability to provide high, steady current income. Real estate also has moderate correlation with other asset classes and thus provides some diversification benefits. However, there are periods when equity REIT correlations with other securities are high, and their correlations are highest during steep market downturns.

The assets underlying infrastructure investments are real, capital intensive, and long-lived. These assets are intended for public use, and they provide essential services e.g., airports, health care facilities, and power plants.

Infrastructure assets were primarily owned, financed, and operated by the government. Of late, they are financed privately through the use of public-private partnerships (PPPs). The provider of the assets and services has a competitive advantage as the barriers to entry are high due to high costs and regulation.

Investors invest in infrastructure assets because:

Categories of Infrastructure Investments

Infrastructure investments may be categorized based on: (1) underlying assets, (2) stage of development of the underlying assets, and (3) geographical location of the underlying assets. Let us look at the various sub-categories now.

Infrastructure investments based on underlying assets: They can be classified into economic and social infrastructure assets.

Infrastructure investments based on the stage of development of the underlying assets: They can be classified into brownfield and greenfield investments.

Infrastructure assets may also be categorized based on their geographical location.

Forms of Infrastructure Investments

Investors may invest either directly or indirectly in infrastructure investments. The investment form affects the liquidity and the income and cash flows to the investor.

The advantages of investing directly in infrastructure are that investors have a control over the asset and can capture the full value of the asset. But the downside of a large investment is that it results in concentration and liquidity risks.

Most investors invest indirectly. Some forms of indirect investments include:

Investing in publicly traded infrastructure companies offer the benefit of liquidity. Publicly traded infrastructure securities also have a reasonable fee structure, transparent governance, and provide the benefit of diversification. Master limited partnerships (MLPs) are pass-through entities similar to REITs and are listed on exchanges.

Infrastructure investments with the lowest risk have stable cash flows and higher dividend payout ratios, but they also have lower expected returns and lesser growth opportunities. An example of a low-risk infrastructure investment is toll roads. An example of a high-risk infrastructure investment is a fund building a new power plant (a greenfield investment).

Some of the risks associated with infrastructure investments include:

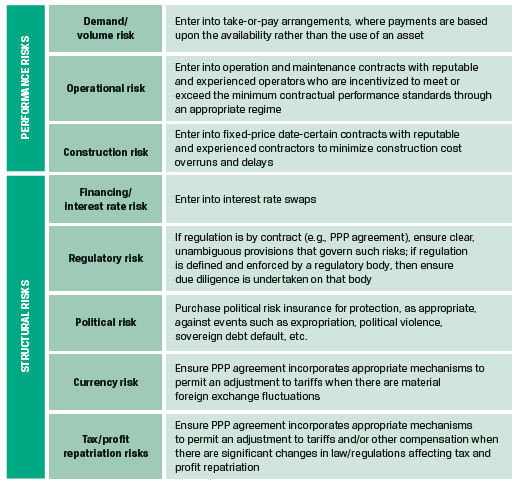

Exhibit 17 from the curriculum shows the typical risk management considerations for various risks of infrastructure investments.

Some of the advantages to investors from investing in infrastructure are as follows:

Natural resources include:

Up to about 20 years ago, investors looking for exposure to natural resources invested mainly via financial instruments (stocks and bonds). Instead of investing in the physical land and the products that come from it, investors focused on the companies that produced natural resources. Nowadays, however, due to the wide variety of direct investments available (ETFs, limited partnerships, REITS, swaps, and futures), investors typically participate in these assets directly.

Commodities are physical products that can be standardized on quality, location, and delivery for investment purposes.

Generally, commodity investments take place through derivative instruments, because of the high storage and transportation costs incurred when holding commodities physically. The underlying asset of a commodity derivative may be a single commodity or an index of commodities. The return on commodity investment is based mainly on price changes rather than an income stream such as dividends.

In order to be transparent, investable, and replicable, commodity indexes typically use the price of the futures contracts rather than the prices of the underlying physical commodities.

Commodity sectors include:

How are commodity futures contracts priced?

Future price ≈ Spot price (1 + r) + Storage costs – Convenience yield

where: convenience yield is the value associated with holding the physical asset;

r is the short-term risk-free interest rate

Contango: Future price > Spot price Markets tend to be in contango when there is little or no convenience yield.

Backwardation: Future price < Spot price Markets tend to be in backwardation when the convenience yield is high

Digital Commodities:

Digital assets can be thought of as anything that can be stored and transmitted electronically and has associated ownership or use rights. Digital assets may take many forms (such as digital tokens and virtual currencies) and may utilize various underlying technologies, including distributed ledger technology (DLT).

Forms of Commodity Investments

Commodity investments are typically made through derivatives as the storage and transportation costs for holding physical commodities are significant. Commodity derivative contracts may trade on exchanges or over the counter. The popular derivatives include futures, forwards, options, and swaps.

Commodity exposure can also be achieved through:

Timberland

Timberland provides an income stream through the sale of trees, wood, and other timber products. Timberland can be thought of as both a factory and a warehouse. The trees can be easily stored by simply not harvesting them. The trees can be harvested based on the price: more harvest when prices are up and delayed harvest when prices are down.

The three return drivers for timberland investments include: biological growth, change in prices of lumber (cut wood), and underlying land price change.

Additionally, since trees consume carbon as part of their life cycle, timberland considered a sustainable investment that mitigates climate-related risks.

Farmland

Farmland is perceived to provide a hedge against inflation. Two types of farm crops include raw crops that are planted and harvested, and permanent crops that grow on trees. Like timberland, farmland also provides an income component related to harvest quantities and agricultural commodity prices. However, it does not provide production flexibility, as farm products must be harvested when ripe.

Similar to timber land, the return drivers for farmland are: harvested quantities, commodity prices, and land price appreciation.

Forms of Timberland and Farmland Investments

The primary investment vehicles for timberland and farmland are investment funds. These funds could be offered publicly via REITs or privately via limited partnerships.

Large investors can also consider direct investments in these assets.

Risk/Return: Commodities

Commodities offer potential for returns, portfolio diversification, and inflation protection.

Commodity spot prices are a function of supply and demand, the costs of production and storage, value to users, and global economic conditions.

Risk/Return: Timberland and farmland

Timberland and farmland investments have similar risks as other real estate investments in raw land. However, weather is major risk factor for these investments. Bad weather conditions can drastically reduce harvest yields.

Another important risk factor is the international competitive landscape. Unlike other real estate that is mainly impacted by local factors, timberland and farmland produce commodities that are globally traded; therefore, they are impacted by global factors.

Diversification Benefits: Commodities

Commodities are attractive to investors not only for the potential profits but also because:

Diversification benefits: Timberland and farmland

ESG investors looking for responsible and sustainable investing can include timberland and farmland in their portfolios. These investments can help mitigate climate change.

Timberland and farmland have also exhibited low correlation with traditional investments. Thus, they can provide effective diversification benefits.

History: Hedge funds were originally started in 1949 as a way to hedge long-only stock portfolio. These funds followed three key principles:

Over time, the principles have changed. The following are the characteristics of hedge funds today:

There are several hedge fund strategies. These fall in four major categories:

The sub-classifications under each category are listed below:

| Sub-classification under event-driven category | |

| Merger Arbitrage | · Go long (buying) on the stock of the company being acquired and go short on the stock of the acquiring company.

· Risk: many corporate events such as merger do not occur as planned and if the fund has not closed its positions on time, it may incur losses. |

| Distressed/restructuring | · Purchase and profit from debt securities of companies that are either in bankruptcy or near bankruptcy.

· Strategy: the fixed income securities would be priced at a significant discount to their par value; these can be sold later at a profit at settlement (liquidation or equity stake) · Other complicated strategies: Buy senior debt/short junior debt. · Buy preferred stock/short common stock. |

| Activist | · Purchase a managing equity stake in a public company that is believed to be mismanaged, and then influence its policies.

· May advocate restructure, changes in strategy, hiving off non-profitable units, etc. |

| Special Situations | · Purchase equity of companies engaged in restructuring activities other than merger/bankruptcy. |

| Sub-classification under relative value category | |

| Fixed-Income Convertible Arbitrage | · A market neutral strategy to exploit mispricing in convertible bond and issuer’s stock.

· Long position in convertible debt + short position in issuer’s common stock. · As the name implies, it has a theoretical zero-beta portfolio. Note: A convertible bond is a bond (hybrid security) that can be converted into common stock at a pre-determined price at a pre-determined time. Usually, the yield is lower than a comparable bond. |

| Fixed-Income Asset Backed | · Exploit mispricing of asset-backed securities. |

| Fixed-Income General | · Exploit mispricing between two corporate issuers (i.e. long/short trades), between corporate and government issuers, or between different parts of the same issuer’s capital structure. |

| Volatility | · Go long or short market volatility within a specific asset class. |

| Multi-Strategy | · Generate consistently absolute positive returns irrespective of how the equity, debt, or currency markets are performing.

· Does not focus on one strategy, but allocates capital across different strategies where investment opportunities exist. Ex: equity long/short, convertible arbitrage, merger arbitrage, etc. · Unlike funds of funds, multi-strategy funds execute strategies within one fund group and they do not have the extra layer of fees associated with a fund of funds. |

| The curriculum does not present any sub-classifications under the macro category. | |

| Sub-classifications under the equity hedge category | |

| Market Neutral | · Uses quantitative/fundamental analysis to identify undervalued/overvalued securities.

· Strategy: buy (long) undervalued securities and sell (short) overvalued securities. Hold equal dollar amounts in both positions. · Neutral with respect to market risk, i.e., the portfolio beta is close to zero. |

| Fundamental Growth | · Uses fundamental analysis to identify companies with high growth potential and capital appreciation.

· Strategy: long position in such stocks. |

| Fundamental Value | · Uses fundamental analysis to identify undervalued companies.

· Strategy: long position in such stocks. |

| Short Bias | · Uses quantitative/fundamental analysis to identify overvalued securities.

· Strategy: short position in overvalued securities. |

| Sector Specific | · Uses quantitative/fundamental analysis to identify mispricing in a specific sector.

· Strategy: long on undervalued securities/short on overvalued securities. |

Selecting and investing in an individual hedge fund can be difficult because of the extensive due diligence required and the high minimum investment threshold. Therefore, some investors may prefer to invest in a fund of hedge funds.

A diversified portfolio of hedge funds is often referred to as a fund of funds. This instrument makes hedge funds accessible to smaller investors or to those who do not have the resources, time, or expertise to choose among hedge fund managers. Other benefits include:

However, fund of funds may charge an additional 1% management fee and 10% incentive fee on top of the fees charged by the underlying hedge funds. This double layer of fees can significantly reduce the after fee returns to the investor.

Hedge fund indexes suffer from self-reporting and survivorship biases. Historically, hedge funds have provided higher returns than either stocks or bonds with a relatively low standard deviation. They have certainly added value to institutional investors as a portfolio diversifier.

Due to different strategies across hedge funds, the diversification benefits associated with every hedge fund is not necessarily meaningful. It is believed that less-than-perfect correlation of hedge funds with stocks provides diversification benefit. However, during financial crisis periods, the correlation between hedge fund performance and stock market performance may increase.

Between 2009 – 2019, most hedge funds failed to beat the performance of equity and bonds. But they still continue to be a part of institutional asset allocations because of their risk-diversification properties.