IFT Notes for Level I CFA® Program

LM01 Categories, Characteristics, and Compensation Structures of Alternative Investments

Part 1

1. Introduction

This learning module covers:

- Types and categories of alternative investments

- Methods of investing in alternative investments; the advantages and disadvantages of each method

- Investment and compensation structures commonly used in alternative investments

Traditional investments refer to long-only positions in stocks, bonds, and cash. All other investments are classified as alternative investments.

Alternative investments can be divided into three main categories:

- Private capital

- Real assets

- Hedge funds

Why Investors Consider Alternative Investments

Since the mid-1990s assets under management in alternative investments have grown significantly. Institutional investors such as endowments and pension funds, and family offices have primarily contributed to this growth.

These investors consider alternative investments due to:

- The potential for portfolio diversification. Alternative investments have low correlation with traditional asset classes.

- The opportunities for enhanced returns. Adding alternative investments can increase the portfolio’s risk-return profile.

- The potentially increased income through higher yields. During low-interest rate periods, alternative investments can provide significantly higher yields as compared to traditional investments.

The general characteristics of alternative investments are listed below:

- Narrow manager specialization: For example, within private equity, you have leveraged buyout and venture capital. There are managers who focus only on leveraged buyouts within private equity.

- Relatively low correlation with traditional investments. But correlation may increase during times of financial crises.

- Low level of regulation and less transparency as compared to traditional investments

- Limited and potentially problematic risk and return data: The risk and return data of hedge fund and private equity indices are biased, as we will see later.

- High fees because of active management and expertise required in managing the portfolio. The fees often include performance or incentive fees.

- Concentrated portfolios

- Restrictions on redemptions (i.e., “lockups” and “gates”)

Categories of Alternative Investments

The main categories of alternative investments are:

Private capital

Private equity:

- Private equity funds invest in the equity of private companies or public companies that want to become private.

- They are further divided into

- Leveraged buyout funds: Invest in established companies.

- Venture capital funds: Invest in startups or early-stage companies.

Private debt:

- Includes debt provided to private entities.

- Forms of private debt include:

- Direct lending: private loans with no intermediary.

- Mezzanine loans: private subordinated debt.

- Venture debt: private loans to startups or early-stage companies.

- Distressed debt: private loans to distressed companies, e.g., companies facing bankruptcy.

Real Assets

Real estate:

- Investments in buildings or land either directly or indirectly.

- Securitization has broadened the definition of real estate investing and it now includes:

- Private commercial real estate equity: e.g., ownership of an office building

- Private commercial real estate debt: e.g., directly issued mortgages on commercial property

- Public real estate equity: e.g., real estate investment trusts (REITS)

- Public real estate debt: e.g., mortgage-backed securities (MBS).

Infrastructure:

- Investments in capital intensive, long-lived, real assets such as roads, dams, and schools, which are intended for public use and provide essential service.

- A common approach to infrastructure investing is a public–private partnership (PPP) in which both the government and investors have a stake.

Natural Resources:

Commodities:

- Investment in physical assets such as grains, metals, crude oil, etc.

- Commodity investments can be done by either owning physical assets, using derivative products, or investing in business engaged in the exploration and production of physical commodities.

Agricultural land (or farmland):

- Investments in land used for the cultivation of crops or livestock.

- Income can be generated from the growth, harvest and sale of crops or livestock; or by leasing the land back to farmers.

Timberland:

- Investments in natural forests or managed tree plantations.

- The return comes from the sale of trees, wood, and other timber products.

Others:

- Investments in any other tangible asset such as art, fine wine, stamps, coins, etc.

- Or intangible assets such as patents and litigation actions.

Hedge funds

- They are private investment vehicles that manage portfolios of securities and derivative positions using a variety of strategies.

- Some hedge funds aim for absolute returns independent of market performance.

2. Investment Methods

Methods of Investing in Alternative Investments

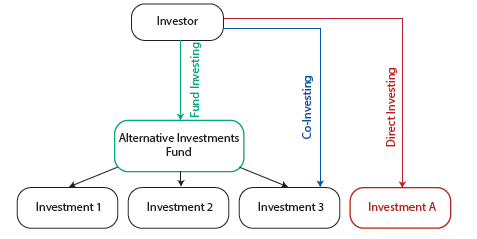

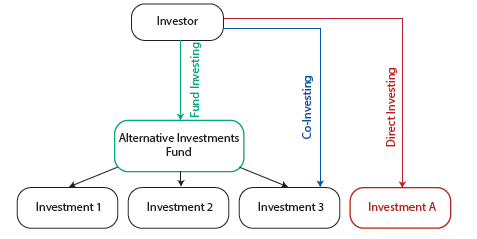

The three methods of investing in alternative investments are:

- Fund investing: The investor contributes capital to a fund, and the fund makes investments on the investors’ behalf, e.g., investments in a PE fund.

- Co-investing: The investor can make investments alongside a fund, e.g., investments in a portfolio company of a fund. In co-investing, the investor is able to invest both directly and indirectly in the same assets.

- Direct investing: The investor makes a direct investment in a company or project without the use of an intermediary, e.g., direct investments in infrastructure or real estate assets.

Exhibit 1 from the curriculum illustrates the three methods of investing in alternative investments:

Advantages and Disadvantages of Direct Investing, Co-Investing, and Fund Investing

Exhibit 2 from the curriculum summaries the advantages and disadvantages of the different methods of investing.

|

Advantages |

Disadvantages |

| Fund investing |

· Lower level of investor involvement as the fund managers provide investment services and expertise

· Access to alternative investments without possessing a high degree of investment expertise

· Lower minimum capital requirements |

· Costly management and performance fees

· Investor must conduct thorough due diligence when selecting the right fund because of the wide dispersion of fund manager returns

· Investors less able to exit the investment as funds typically have lock-ups and other restrictions |

| Co-investing |

· Investors can learn from the fund’s process to become better at direct investing

· Reduced management fees

· Allows more active management of the portfolio compared with fund investing and allows for a deeper relationship with the manager |

· Reduced control over the investment selection process compared with direct investing

· May be subject to adverse selection bias

· Requires more active involvement compared with fund investing, which can be challenging |

| Direct investing |

· Avoids paying ongoing management fees to an external manager

· Greatest amount of flexibility for the investor

· Highest level of control over how the asset is managed |

· Requires more investment expertise and a higher level of financial sophistication resulting in higher internal investment costs

· Less access to a fund’s ready diversification benefits or the fund manager’s sourcing network

· Requires more complex due diligence because of the absence of a fund manager

· Higher minimum capital requirements |

Due Diligence for Fund Investing, Direct Investing, and Co-Investing

Due diligence for direct investing

- The investor has control over which portfolio company to invest in; the focus of the due diligence is the company itself.

- As compared to the other methods, direct investing requires considerable expertise.

Due diligence for fund investing

- The fund manager performs due diligence on the underlying investments.

- The investor is responsible for performing due diligence on the fund manager when choosing which funds to invest in.

Due diligence for co-investing

- Since direct investing is an element of co-investing, the due diligence process is similar to direct investing.

- The key difference between the two is that: In co-investing, investors often depend heavily on the due diligence conducted by the fund manager. Whereas, direct investing due diligence is more independent.

3. Investment and Compensation Structures

Partnership Structures

The most common structure for many alternative investments is a partnership. It consists of two entities:

- General partner (GP): The fund manager is the general partner (GP). The GP is responsible for managing the fund and making investment decisions. The GP theoretically bears unlimited liability for anything that goes wrong.

- Limited partners (LP): LPs are outside investors who provide capital to the fund in return for a fractional partnership in the fund. They bear the risk associated with investments. LPs usually play a passive role and are not involved with the management of the fund.

The partnership between the GP and LPs is governed by a limited partnership agreement (LPA). It is a legal document that outlines the rules of the partnership and establishes the framework for the fund’s operations.

In addition to LPAs, side letters may also be negotiated, which are additional terms between the GP and certain LPs that exist outside the LPA (which is a common document for all LPs).

Other structures may be adopted for specific alternative investments. For example:

- Infrastructure investors often enter into public-private partnerships, which are agreements between the public sector and private sector.

- Real estate direct investing often involves a joint venture structure.

- Real estate fund investing often involves a unitholder structure.

Compensation Structures

The general partner typically receives a management fee based on assets under management (commonly used for hedge funds)or committed capital (commonly used for private equity). Management fee typically ranges from 1% to 2%.

Apart from the management fee, the GP also receives a performance fee (also called incentive fee or carried interest) based on realized profits. Performance fees are designed to reward GPs for good performance. A common fee structure is 2 and 20 which means 2% management fee and 20% performance fee.

Generally, the performance fee is paid only if the returns exceed a hurdle rate (also called a preferred rate). A hurdle rate of 8% is typically used.

- Hard hurdle rate: The GP earns fees on annual returns in excess of the hurdle rate.

- Soft hurdle rate: The GP earns fees on the entire annual gross return as long as the set hurdle is exceeded.

Common Investment Clauses, Provisions, and Contingencies

Common investment clauses, provisions and contingencies specified in the LPA include:

Catch-up clause: A catch-up clause allows the GP to receive 100% of the distributions above the hurdle rate until he receives 20% of the profits generated, and then every excess dollar is split 80/20 between the LPs and GP. This clause is meant to make the manager whole so that their incentive fee is a function of the total return and not solely on the return in excess of the hurdle rate.

Example:

Assume that the GP has earned an 18% IRR on an investment, the hurdle rate is 8%, and the partnership agreement includes a catch-up clause.

In this case the distribution would be as follows:

- The LPs would receive the entirety of the first 8% profit.

- The GP would receive the entirety of the next 2% profit—because 2% out of 10% amounts to 20% of the profits accounted for so far.

- The remaining 8% would be split 80/20 between the LPs and the GP

Thus, the GP effectively earns: 18% x 20% = 3.6% and the LP effectively earns 18% x 80% = 14.4%.

In the absence of a catch-up clause the distributions would have been:

- The LPs would still receive the entirety of the first 8% profit.

- The remaining 10% would be split 80/20 between the LPs and GP.

Thus, in this case the GP effectively earns a lower return of (18% – 8%) x 20% = 2.0%

High water mark: In some cases, the incentive fee is paid only if the fund has crossed the high-water mark. A high-water mark is the highest value net of fees (or the highest cumulative return) reported by the fund so far for each of its investors. This is to ensure investors do not pay twice for the same performance.

Waterfall: The waterfall defines the way in which cash distributions will be allocated between the GP and the LPs. In most waterfalls, a GP receives a disproportionately larger share of the total profits relative to their initial investment. This is typically done to incentivize GPs to maximize profitability.

There are two types of waterfalls:

- Whole-of-fund (or European) waterfalls: As deals are exited, all distributions go to the LPs first. The GP does not participate in any profits until the LPs receive their initial investment and the hurdle rate has been met.

- Deal-by-deal (or American) waterfalls: Performance fees are collected on a per-deal basis. This is more advantageous for a GP as he can get paid before LPs receive both their initial investment and their preferred rate of return on the entire fund.

Clawback: A clawback provision allows LPs to reclaim a part of the GP’s performance fee. For example, if a fund makes profitable exits in early years, but the subsequent exits are less profitable, then the GP has to pay back profits to ensure that the profit split is in line with the fund prospectus.

Share on :