Capital structure refers to the specific mix of debt and equity a company uses to finance its assets and operations.

This reading covers:

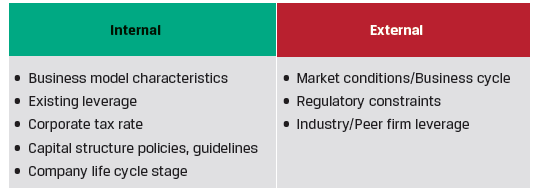

Exhibit 1 from the curriculum shows the primary internal and external factors that affect a company’s capital structure.

We will discuss each of these in detail.

Business model characteristics

A company’s business model can greatly impact its capital structure by influencing its ability to service debt. Key factors that differ among business models include:

Revenue, earnings, and cash flow sensitivity:

Some companies like Vodafone in the telecom industry, have very stable revenue streams because a large proportion of their revenues are subscription-like, recurring revenues. This is generally viewed as a positive for its ability to support debt, because their revenues are less affected by fluctuations in the business cycle.

In contrast, companies in cyclical industries, such as Toyota in the automobile industry, have more volatile revenue streams that are highly sensitive to fluctuations in the business cycle. This is viewed as a negative for the company’s ability to support debt.

Also, companies with pay-per-use business models, rather than subscription-based models, are likely to have a lower degree of revenue predictability. This reduces their ability to support debt.

Generally, stable revenue streams should result in stable earnings and cash flow streams. But the company’s cost structure (the proportion of fixed and variable costs) also plays a role. Companies with higher operating leverage (operating leverage = fixed costs / variable costs) have high earnings and cash flow volatility as compared to firms with low operating leverage. Thus, high operating leverage reduces a company’s ability to support debt.

Exhibit 2 from the curriculum summarizes these relationships:

| Business Model Factor | Ability to Support Debt |

| High (low) revenue, cash flow volatility | Reduced (increased) |

| High (low) earnings predictability | Increased (reduced) |

| High (low) operating leverage | Reduced (increased) |

Asset Type:

A company’s assets can be broadly classified as:

From a creditor’s perspective, tangible assets are considered safer than intangible assets as they can better serve as debt collateral. So companies with mostly tangible assets (e.g. oil and gas, and real estate industries) can operate with a higher proportion of debt as compared to companies with mostly intangible assets (e.g. software industry).

Similarly, creditors prefer fungible liquid assets over non-fungible, illiquid assets.

Therefore, companies with greater fungible, tangible, liquid assets can support a higher level of debt.

Asset Ownership:

Some ‘asset-light’ companies may choose not to own assets but instead ‘out-source’ asset ownership to other parties. For example, Uber and Airbnb. This strategy, reduces the amount of assets on the balance sheet, reduces operating leverage, and allows companies to maximize their flexibility and ability to scale quickly.

The effect of this strategy on the ability to support debt is mixed, On one hand, the lower operating leverage can support higher debt levels. On the other hand, a lower proportion of tangible assets on the balance sheet reduces the ability to support debt.

The existing financial leverage of a firm influences its capital structure decisions. Highly leveraged firms face a higher risk of default and, as a result, have less capacity to service additional debt. Underleveraged firms, on the other hand, can support additional debt relatively easily.

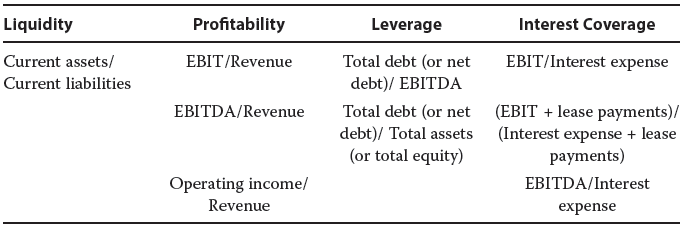

The following ratios are commonly used to determine a company’s ability to support additional debt (Exhibit 4 from the curriculum):

Exhibit 5 presents the relationship between the above ratios and the ability to support debt.

| Financial Ratio Type | Ability to Support Debt |

| Higher (lower) liquidity | Increased (reduced) |

| Higher (lower) profitability | Increased (reduced) |

| Higher (lower) leverage | Reduced (increased) |

| Higher (lower) interest coverage | Increased (reduced) |

Corporate Tax Rate

In many countries, interest expense is a tax-deductible expense. As a result of the tax savings, a company’s after-tax cost of debt will be lower than the actual cost. The higher (lower) the firm’s marginal income tax rate, the greater (lower) the tax benefit of using debt in the firm’s capital structure.

Capital Structure Policies/Guidelines

Many companies establish capital structure polices that define the acceptable levels of debt in the capital structure. For example,

To come up with these thresholds, companies may start with debt covenants or rating agency thresholds and add a cushion or ‘margin of safety’ to ensure that the actual thresholds are not breached.

Another important consideration is whether their debt or equity issuance meets index provider requirements. Inclusion in a benchmark index can significantly affect the demand for these securities.

Third-Party Debt Ratings

Debt ratings are independent, third-party assessments of the quality and safety of a company’s debt. They are based on the analysis of the company’s ability to pay the promised cash flows. Debt ratings are an important factor in the practical management of leverage. Since borrowing costs are closely tied to the bond ratings, maintaining the company’s rating at a certain level can also be an explicit goal for management.

As leverage rises, rating agencies tend to lower the ratings of the company’s debt. This is done to reflect the higher credit risk resulting from the increasing leverage. Lower ratings signify higher risk to both equity and debt capital providers, who in turn demand higher returns.

Market Conditions/Business Cycle

A company’s cost of debt is equal to a benchmark risk-free rate plus a credit spread specific to the company. Market conditions/ business cycle affect both the benchmark rates and the credit spreads. The credit spreads tend to widen during recessions and tighten during expansions.

Companies may increase their use of debt when borrowing is less expensive due to low benchmark interest rates and/or tight credit spreads, and vice versa.

Cyclical industries: The revenues and cash flows of companies in cyclical industries (e.g., mining) fluctuate widely with the business cycle. Therefore, such companies tend to use less debt in their capital structure as compared to other companies in less cyclical industries.

The capital structures of some firms are regulated by government or other regulators. For example, financial institutions are required to maintain certain levels of solvency or capital adequacy, as defined by regulators.

Industry/Peer Firm Leverage

Companies in the same industry tend to have fairly similar capital structures. This is because they are likely to have similar assets and business model characteristics. For example, companies in the automobile industry tend to own large proportions of tangible, non-fungible fixed assets in the form of property, plant, and equipment, with significant proportions of debt in their capital structures.

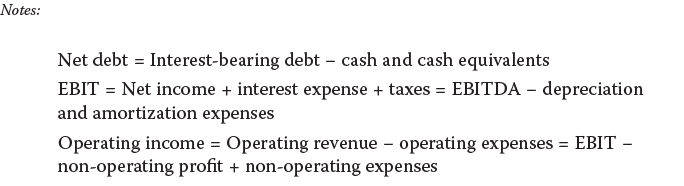

In this section we will look at the typical changes in a company’s capital structure as it evolves from a start-up, to a growth business, to a mature business.

A company’s life cycle stage influences its cash flow characteristics, its ability to support debt; and is therefore a primary factor in determining capital structure. Any capital that is not sourced through borrowing must come from equity.

As companies mature and move from start-up, through growth, to maturity, their business risk typically declines, and their operating cash flows turn positive and become more predictable. This allows for greater use of leverage at more attractive terms. This is illustrated in Exhibit 7 from the curriculum.

In the preceding sections we established a general relationship between company maturity and capital structure. However, there are two important exceptions: