Working capital (also called net working capital) is defined as current assets minus current liabilities.

Working capital = Current assets – Current liabilities

Working capital includes both operating assets and liabilities (such as accounts receivable, accounts payable, inventory etc.) as well as financial assets and liabilities (such as short-term investments and short-term debt).

The goal of effective working capital management is to ensure that a company has adequate ready access to the funds necessary for day-to-day operating expenses, while avoiding excess reserves that can reduce a business’s profitability.

This reading covers:

Exhibit 1 from the curriculum shows the main internal and external sources of capital for a company.

| Internal | External | ||

| Financial Intermediaries | Capital markets | ||

| Short-term

|

· After-tax operating cash flows

· Accounts payable · Accounts receivable · Inventory · Marketable securities |

· Uncommitted lines of credit

· Committed lines of credit · Revolving credit · Secured loans · Factoring |

· Commercial paper

|

| Long-term | · Long-term debt

· Equity |

||

We will discuss each of these sources in detail.

Companies can generate internal financing from short-term operating activities in many ways such as:

Some important terms related to internal financing are:

Example: Internal Financing Decision

(This is based on Example 1 from the curriculum.)

A company is evaluating two options to fund its working capital needs:

Which option should the company prefer?

Solution:

The effective annual rate on the forgone trade credit can be calculated as:

[(1+(2/98))^(365/20)] – 1 = 44.6%This is significantly higher than the 7.7% rate on the external credit line. Therefore, the company should prefer the credit line.

Financial intermediaries can include both bank or non-bank lenders. The main type of financing options available through these sources are:

A company can also sell its accounts receivables to a lender (called a factor), typically at a substantial discount. This is called a factoring arrangement. In an assignment arrangement, the company retains the collection responsibilities, whereas in a factoring arrangement, the company shifts the collection responsibilities to the lender (factor).

Web-based lenders and non-bank lenders are recent innovations that operate primarily on the internet. They typically offer loans in relatively small amounts to small businesses in need of cash.

Short-Term Commercial Paper

It is a short-term, unsecured instrument typically issued by large, well-rated companies. It has maturities typically ranging from a few days to 270 days. Issuers of commercial paper are often required to have a backup line of credit. The short duration, high creditworthiness of the issuing company, and the backup line of credit generally makes commercial paper a low-risk investment for investors.

Long-Term Debt

It has a maturity of at least one year. Due to their long maturities, bonds are riskier than shorter-term notes or money market instruments from an interest rate and credit risk perspective. Therefore, to reduce risk, bonds often contain covenants that are detailed contracts specifying the rights of the lender and restrictions on the borrower.

Public debt is negotiable (a negotiable instrument is a written document describing the promise to pay that is transferable and can be sold to another party) and more liquid as it trades on open markets. Private debt can also be negotiable, but it is less liquid and difficult to sell as it does not trade on open markets. Some private debt instruments, such as savings bond and certificates of deposit are not negotiable.

Common Equity

Common equity represents ownership in a company. It is considered a more permanent source of capital. Shareholders have a residual claim on the company’s profits after its obligations and other contractual claims are satisfied.

Example: External Financing Decision

(This is based on Example 2 from the curriculum.)

A company is planning its financing for a substantial investment of C$30 million next year. Specific details are as follows:

How much, if any, does the company need to issue in long-term bonds?

Solution:

Total amount receivable from different sources of capital for the company can be calculated as:

| Source | Amount |

| Operating cash flow (Net income + depreciation – dividends) | 11 |

| Accounts payable | 3 |

| Bank loan against receivables | 3 |

| Short-term note | 4 |

| Total | 21 |

Since, the company requires C$30 million of financing and the planned sources total C$21 million, the company will need to issue C$9 million of new bonds.

To determine their required working capital investment, companies first identify their optimal levels of inventory, receivables and payables as a function of sales. They then project these assumptions forward into the future.After determining its working capital requirements, a firm then identifies the optimal mix of short-and long-term financing necessary to fund these requirements. Companies may take different approaches to working capital management:

Instructor’s Note: Current assets can be divided into ‘permanent current assets’ and ‘variable current assets.’ Permanent current assets remain relatively constant throughout the year. Variable current assets vary based on the seasonality of the business, increasing during peak production periods.In a conservative approach, the firm finances a majority of its current assets (both permanent and variable) with long-term debt or equity financing.

Also, the firm finances a majority of its current assets (both permanent and variable) with short-term debt or payables.

Also, the firm attempts to match the duration of the current assets with the liabilities. It would finance its permanent current assets with long-term debt and equity; and finance its variable current assets with short-term debt and payables.

Example 3 from the curriculum presents the pros and cons of each approach. Excerpts from this example are presented below:

Conservative approach

Aggressive approach

| Pros | Cons |

| Short-term lines of credit provide the flexibility to access financing only when needed—particularly appropriate for seasonality—reducing overall interest expense | Higher levels of short-term cash may be needed to meet short-term debt maturities |

| Short-term loans involve less rigorous credit analysis, as the lender has greater clarity as to the short-term operations of the firm | Potential difficulty in rolling the short-term loans, thus increasing bankruptcy risk, particularly during times of stress |

| Flexibility to refinance if rates decline | Greater reliance on trade credit (expensive financing) may be necessary if the business is unable to refinance at favorable terms |

| Tighter customer credit standards may be required, thereby reducing sales, if the business is unable to access the necessary financing to support credit terms to its customers |

Moderate approach

| Pros | Cons |

| Lower cost of financing than conservative approach | Access to short-term capital may be restricted when needed for inventory build |

| Flexibility to increase financing for seasonal spikes while maintaining a base level for ongoing needs | Potential difficulty in rolling the short-term loans, thus increasing bankruptcy risk, particularly during times of stress |

| Diversifying sources of funding with a more disciplined approach to balance sheet management | Greater reliance on trade credit (expensive financing) may be necessary if the business is unable to refinance at favorable terms |

| Tighter customer credit standards may be required, thereby reducing sales, if the business is unable to access the necessary financing to support credit terms to its customers |

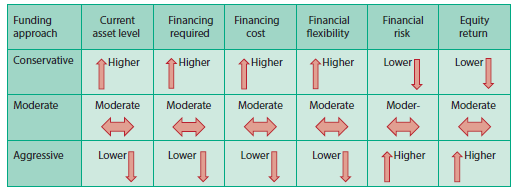

Exhibit 2 fromthe curriculum summarizes the relationship between financing requirements, costs, risks, and return on equity based on funding approach.