Economists Modigliani and Miller claimed that given certain assumptions, a company’s choice of capital structure does not affect its value.

The assumptions made were:

Modigliani and Miller’s work provides us a starting point and allows us to examine what happens when the assumptions are relaxed to reflect real-world considerations.

MM Proposition I: The market value of the company is not affected by the capital structure of the company. This is because individual investors can create any capital structure they prefer for the company by borrowing and lending in their own accounts in addition to holding shares in the company.

VL = VU

where:

VL = value of the levered firm

Vu = value of the unlevered firm

In other words, the value of a company is determined solely by its cash flows, not by the relative reliance on debt and equity capital.

The weighted average cost of capital (WACC) is unaffected by the capital structure.

where: WACC = wd rd + wprp + were

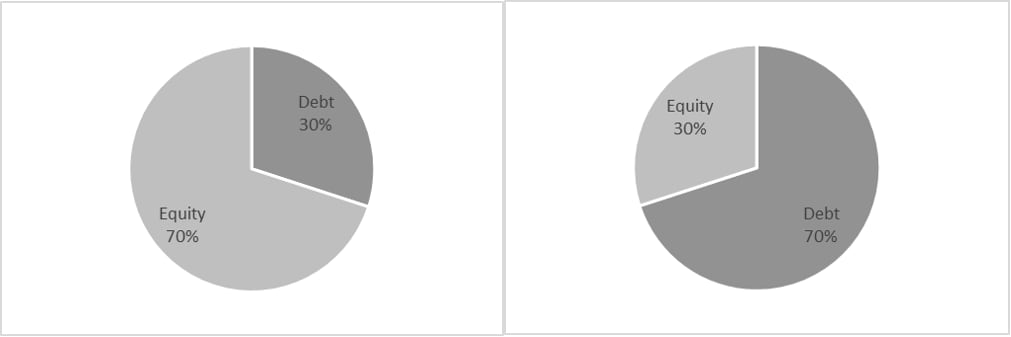

We can explain MM’s capital structure irrelevance proposition in terms of a pie. Suppose the total value of a company is represented by a pie. Slices represents how much of the total capital is contributed by debt and equity. Depending on the capital structure, the pie can be split in any number of ways, but the size of the pie will remain the same. This is illustrated in the figures below.

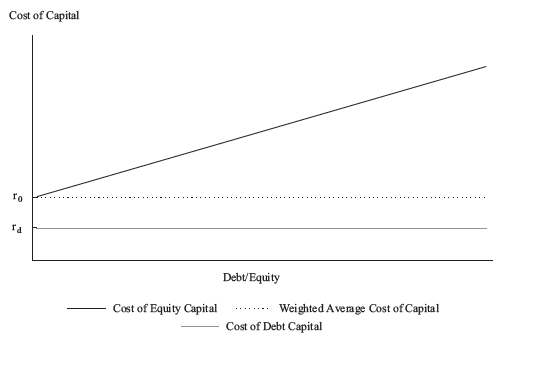

MM Proposition II: The cost of equity is a linear function of the company’s debt-to-equity ratio.

![]()

where:

r0 is the cost of capital for a company financed only by equity and has zero debt

rd is the cost of debt

re is the cost of equity

D/E = debt-to-equity ratio

As D/E rises, i.e. the company increases the use of debt, the cost of equity (re) rises. We know from MM Proposition I that the value of a company is unaffected by changes in D/E and the WACC remains constant. Proposition II then implies that the cost of equity increases in such a manner as to exactly offset the increased use of cheaper debt in order to maintain a constant WACC. Under this proposition, WACC is determined by the business risk of the company, and not by the capital structure.

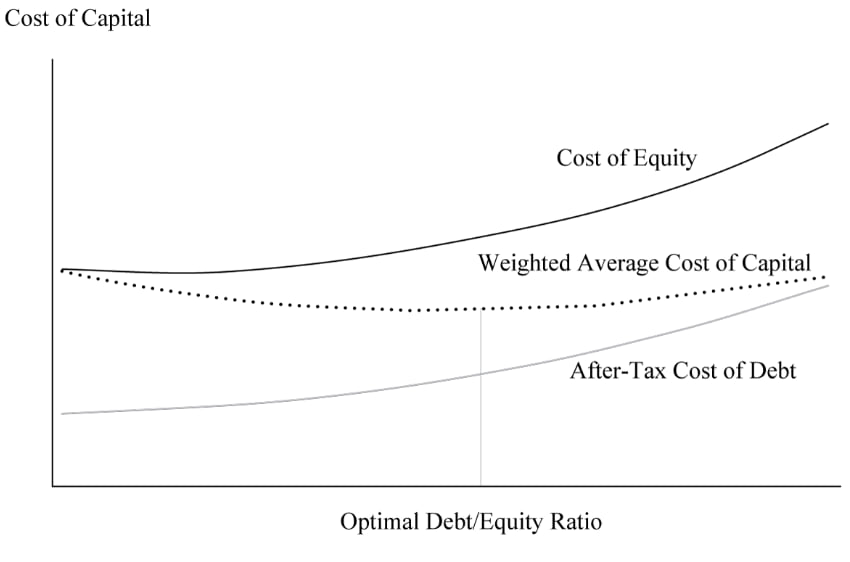

MM Proposition II is illustrated in the figure below.

As leverage increases, the cost of equity increases, but WACC and the cost of debt remain constant.

Systematic Risk

The systematic risk or beta of a company’s assets is a weighted average of the systematic risks of its source of capital.

![]()

where:

βa = asset beta

βd = debt beta

βe = equity beta

According to MM, as the use of debt rises the risk borne by equity holders rises, and therefore the equity beta rises.

![]()

Example: Effect of Leverage on Equity Beta

(This is Example 10 from the curriculum.)

A company is financed with 10% debt and 90% equity.

Solution to 1:

Prior to the change in capital structure, the equity beta is

βe = 0.8 + (0.8 − 0.2)(10/90) = 0.87.

Solution to 2:

After the capital structure change, the equity beta is higher because more debt increases the risk to equityholders. The new equity beta is

βe = 0.8 + (0.8 − 0.2)(30/70) = 1.06.

The discussion so far has ignored taxes. Now, we will present MM propositions I and II with taxes. As interest paid is tax deductible, the use of debt provides a tax shield that increases the value of a company. If we ignore the costs of financial distress and bankruptcy, the value of the company increases as we take on more debt.

MM Proposition I with taxes: The value of a levered company is equal to the value of an unlevered company plus the value of the debt tax shield.

VL=VU+tD

where:

VL = value of the levered firm

Vu = value of the unlevered firm

t = marginal tax rate

D = value of debt in the capital structure

The term tD is often referred to as the debt tax shield

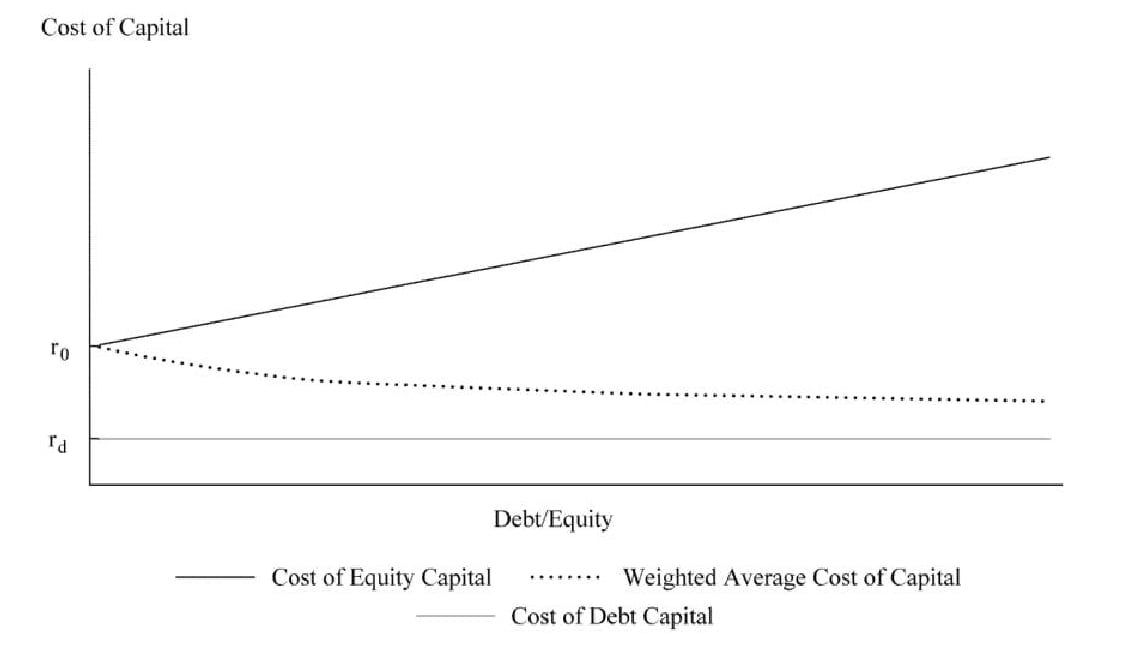

MM Proposition II with taxes: The cost of equity is a linear function of the company’s debt-to-equity ratio with an adjustment for the tax rate.

The cost of equity increases as the company increases the amount of debt in its capital structure, but the cost of equity does not rise as fast as it does in the no tax case.

![]()

WACC for a leveraged company falls as debt increases, and therefore the overall company value increases. This is illustrated in the figure below:

This proposition implies that in the presence of taxes (but no financial distress or bankruptcy costs), the use of debt is value enhancing and, at the extreme, 100% debt is optimal.

The table below provides a summary of MM propositions.

| Without Taxes | With Taxes | |

| Proposition I | VL = VU | VL = VU + tD |

| Proposition II |

The disadvantage of operating and financial leverage is that earnings are magnified downward during economic slowdown. Lower or negative earnings put companies under stress, and this financial distress adds costs to a company.

The costs of financial distress can be classified into direct and indirect costs. Direct costs include the actual cash expenses associated with the bankruptcy process, such as legal and administrative fees. Indirect costs include forgone investment opportunities, impaired ability to conduct business, and agency costs associated with the debt during periods in which the company is near or in bankruptcy.

The costs of financial distress are lower for companies whose assets have a ready secondary market. For example, airlines, shipping companies etc.

The probability of financial distress and bankruptcy increases as the degree of leverage increases. The probability of bankruptcy depends, in part, on the company’s business risk. Other factors that affect the likelihood of bankruptcy include the company’s corporate governance structure and the management of the company.

So far in our discussion of the MM propositions, we have only relaxed the assumption of no corporate taxes. We now consider a scenario that includes both corporate taxes and the costs of bankruptcy/financial distress.

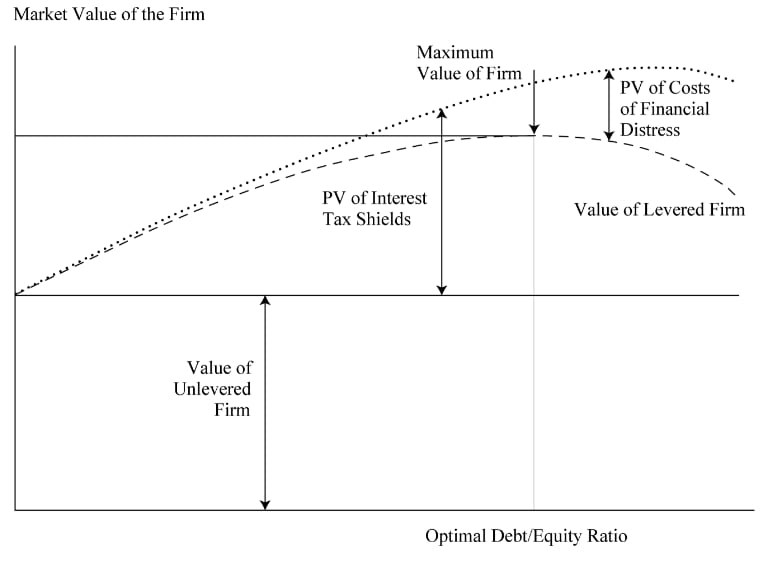

The optimal capital structure is the one at which the value of the company is maximized.

The static trade-off theory is based on balancing the expected costs from financial distress against the tax benefits of debt service payments. Considering both the tax shield provided by debt and the costs of financial distress, the expression for the value of a leveraged company becomes:

![]()

This equation represents the static trade-off theory of capital structure. It results in an optimal capital structure where debt is less than 100%. At low levels of debt, the tax benefits of debt outweigh the PV of financial distress, and the firm’s value increases. However, as more debt is added, the PV of financial distress begins to rise. At the optimal debt/equity ratio point, the PV of financial distress is equal to the tax benefit of debt, and the firm value is maximum. If more debt is added beyond this point, the PV of financial distress outweigh the tax benefits of debt, and the firm’s value decreases.

These concepts are illustrated in Exhibit 10 from the curriculum.

WACC is minimum at the point where the firm value is maximized.

When a company identifies its most appropriate capital structure, it may adopt this as its target capital structure. However, a company’s capital structure may vary from its target because management may try to take advantage of short-term opportunities in alternate financing sources. Market value variations also continuously affect the company’s capital structure. Sometimes, it may be impractical and expensive for a company to maintain its target structure.

In practice, it is difficult to precisely determine the optimal capital structure, because of the difficulty in estimating some costs, such as the costs of financial distress. Therefore, managers often use an optical capital structure range instead of a precise ratio. For example, instead of saying exactly 40% debt is optimal, managers can say debt should be in the range of 30% to 50%.

The optimal capital structure should be calculated using the market value of equity and debt. However, company capital structure targets often use book values instead because:

Financing decisions are often opportunistic. Managers consider the share price of their company as well as market interest rates for their debt when deciding when, how much, and what type of capital to raise.

When conducting an analysis if we know the company’s target capital structure, then we should use it in our analysis. However, analysts typically do not know a company’s target capital structure. It can be estimated using one of these methods:

Example: Estimating the Proportions of Capital

(This is based on Example 12 from the curriculum.)

The following information is provided for a company:

Market value of debt: EUR50 million

Market value of equity: EUR60 million

Primary competitors and their capital structures (in millions):

| Competitor | Market Value of Debt | Market Value of Equity |

| A | EUR25 | EUR50 |

| B | EUR101 | EUR190 |

| C | GBP40 | GBP60 |

Calculate the proportions of debt and equity, if the target capital structure is calculated based on:

Solution to 1:

![]()

![]()

Solution to 2:

![]()

![]()

Solution to 3:

A debt-to-equity ratio of 0.7 represents a weight on debt of 0.7/1.7 = 0.4118, so wd = 0.4118 and we = 1 − 0.4118 = 0.5882.

Managers have more information about a company’s performance and prospects than outsiders, such as owners and investors. This is referred to as information asymmetry. Investors demand higher returns when asymmetry of information is high because this increases the probability of agency costs.

Investors closely watch manager’s decision for insights into the company’s future prospects. Managers may provide information to investors (“signaling”) through their choice of financing method. Fixed payment commitments, for example, can indicate management’s confidence in the company’s future prospects.

Being aware of this, managers take into account how their actions might be interpreted by outsiders.

Pecking Order Theory: This theory suggests that managers choose methods of financing that send the least signal to outsiders. The preferred hierarchy for financing is:

Agency Costs: Agency costs are incremental costs that arise from conflicts of interest between managers, shareholders, and bondholders. Agency theory predicts that as the use of debt increases, agency costs to equity will decrease. The more financially leveraged a company is, the less freedom managers have to incur additional debt or waste cash in inefficient ways. This also serves as the basis for the ‘free cash flow hypothesis.’

Free Cash Flow Hypothesis: As per this hypothesis, high debt levels discipline managers by forcing them to manage the company efficiently so that the company can make its interest and principal payments. Thus, by reducing the company’s free cash flows, managers have fewer opportunities to misuse cash.

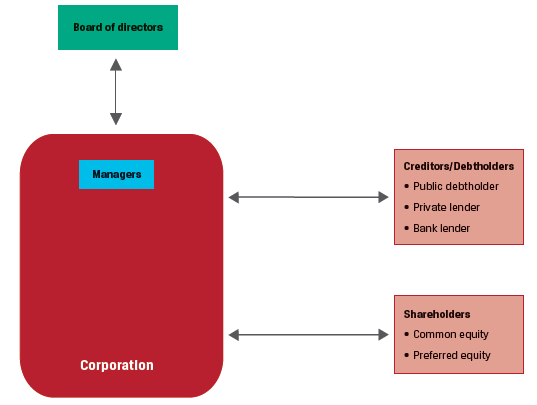

Exhibit 11 from the curriculum shows the key stakeholder groups for a company.

Capital structure decisions impact stakeholder groups differently. Higher financial leverage usually increases the risk for all stakeholders. However, the benefits of increased leverage, accrue almost entirely to shareholders (including senior management and the board). As a result, shareholders and managers acting on their behalf may prefer to increase financial leverage, whereas other stakeholders will not.

Distressed Debt: If the value of the outstanding debt exceeds the value of the enterprise, the company has negative equity. In such scenarios, it is difficult to raise new equity capital and a financial restructuring may be required. By exchanging debt for equity, the company’s capital structure can be repaired, new investments can be financed, and the company can avoid liquidation.

The holders of distressed debt have an equityholder like perspective. The potential upside can be substantial if the company does not default. This makes their risk-return profile similar to that of an equity holder.

Other debt considerations:

Seniority and security:

In the event of a default, secured lenders are likely to recover more of their principal than unsecured lenders. Similarly, senior debt is likely to recover more than subordinated debt.

Safeguards for debtholders:

Debtholders typically impose debt covenants to protect their interests. Positive covenants specify what the borrower must do, such as keep financial ratios within certain limits. Negative covenants specify what the borrower must not do, such as additional secured borrowing or dividend payments.

Companies have an incentive to maintain or improve their creditworthiness since they may need to borrow in the future at favorable terms.

The costs of financial distress can be substantial. Therefore, management will generally take actions to keep the probability of default at very low levels.

Preferred shares are frequently referred to as “hybrid” securities because they possess both debt-like and equity-like characteristics. Failure to pay a preferred dividend is not a default event for a company. Thus, preferred equity creates less risk for a company as compared to debt.

Preferred shareholders are vulnerable to decisions that increase financial leverage and risk over the long term, as this may gradually erode the company’s ability to pay preferred dividends.

Compensation is the primary tool used to align the interests of management, directors, and shareholders. Equity compensation can account for a sizable portion of their total compensation. However, the alignment of managers’ and shareholders’ interests is never perfect. For example, the use of management stock options can encourage excessive risk-taking behavior.