IFT Notes for Level I CFA® Program

LM11 Financial Reporting Quality

Part 2

6. Context for Assessing Financial Reporting Quality

6.1 Motivations

Managers may be motivated to issue financial reports that are not high quality in order to:

- mask poor performance.

- boost the stock price.

- increase personal compensation.

- avoid violation of debt covenants.

6.2 Conditions Conducive to Issuing Low-Quality Financial Reports

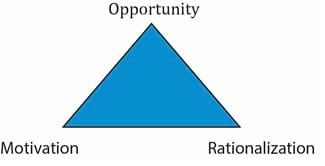

The three conditions conducive for issuing low-quality financial reports are presented below:

Opportunity: It can be the result of weak internal controls, ineffective board of directors, and accounting standards that allow a range of choices.

Motivation: It can result from pressure to meet some criteria for some personal reasons.

Rationalization: It can result from justifying a wrong choice as seen in Enron’s case. Enron’s CFO sought board approvals, legal and accounting opinions for misstated financial statements.

7. Mechanisms that Discipline Financial Reporting Quality

Market Regulatory Authorities

Regulators in every country can play a key role in enforcing financial reporting quality. Examples of regulatory authorities include:

- the SEC (Securities Exchange Commission).

- SEBI (Securities and Exchange Board of India).

- Securities and Futures Commission in Hong Kong.

These regulatory authorities are members of an international organization called the International Organization of Securities Commissions (IOSCO), comprising 120 regulatory authorities and 80 securities market participants like the stock exchanges.

The actual regulation, however, is enforced through each individual regulatory authority in a country. The features of any regulatory regime such as the SEC that affect financial reporting quality include the following:

- Registration requirements: Publicly traded companies must register securities before offering securities for sale to the public. A registration document (often known as a prospectus in an Initial Public Offering) contains current financial statements, future prospects of the company, and securities being offered.

- Disclosure requirements: Publicly traded companies are required to make public periodic reports such as financial statements.

- Auditing requirements: The financial statements must be audited by an independent auditor that states the statements conform to the accounting standards.

- Management commentaries: Financial reports must include statements by the management. Some regulators require a management report containing “(1) a fair review of the issuer’s business, and (2) a description of the principal risks and uncertainties facing the issuer.”

- Responsibility statements: Individuals responsible for company’s filings must issue a statement explicitly acknowledging responsibility and correctness of the information in the reports. Falsely certifying may be considered criminal offence and attract a jail sentence.

- Regulatory review of filings: Regulators conduct reviews periodically to ensure that the rules have been followed.

- Enforcement mechanisms: Regulators have the authority to enforce these rules, without which the rules are of no significance. These powers include fines, barring market participants, or bringing criminal charges.

Auditors

Financial statements of public companies must be audited by an independent auditor. Auditors issue opinions on the financial statements of the company and on the effectiveness of the companies’ internal controls. An unqualified opinion on the financial statements indicates that the financial statements present fairly the company’s performance in accordance with relevant standards. Key audit matters discuss matters of most significance in the audit of the financial statements of the current period.

However, there are some drawbacks of audited opinion:

- It is based on information provided by the company.

- Only a sample is audited, which may not reveal misstatements.

- The intent of the auditor is not to detect fraud, but to ensure that the information is presented fairly.

- The company being audited pays the audit fees. The auditor has an incentive to be lenient to the company being audited in case of a conflict of interest; particularly if the auditor’s firm provides additional services to the company.

Private Contracting

We have seen earlier that managers are motivated to manipulate earnings in order to avoid violating debt covenants or triggers that may prompt investors to recover all or part of their investment.

Consider an example where a company takes a loan from a bank; there is every incentive for the company to dress up its financial reports to keep its cost of capital low. So it is in the best interest of investors, such as the bank here, to monitor the quality of financial reports and detect any misreporting.

Share on :