IFT Notes for Level I CFA® Program

LM04 Understanding Balance Sheets

Part 1

1. Introduction and Components of the Balance Sheet

The balance sheet (also called the statement of financial position) provides information on a company’s resources (assets) and its sources of capital (liabilities and equity). The basic equation underlying the balance sheet is Assets = Liabilities + Equity. In this reading, we look at the different components and presentation formats of the balance sheet, assets, and liabilities in detail, and how to analyze a balance sheet.

1.1 Components and Format of the Balance Sheet

The balance sheet presents the financial position of a company on a particular date, in terms of three elements: assets, liabilities, and equity.

- Assets (A) are what the company owns. They are the resources controlled by the company as a result of past events and they are expected to provide future economic benefits.

- Liabilities (L) are what the company owes. They represent the obligations of a company arising from past events, the settlement of which is expected to result in a future outflow of economic benefits from the entity.

- Equity (E) represents the owners’ residual interest in the company’s assets after deducting its liabilities. It is also known as shareholders’ equity. The accounting equation for determining equity is: E = A – L

Limitations of the balance sheet in financial analysis

- Some assets and liabilities are measured based on historical cost while some are measured based on fair value, which represents its current value as of the balance sheet date. These differences can have significant impact on reported figure.

- The value of an item reported on the balance sheet is the value at the end of the reporting period. If we are analyzing the company at a later date, these values may have changed.

- Some assets and liabilities are difficult to quantify and are not reported on the balance sheet. For example, brand, customer loyalty, human capital, etc.

Presentation formats

A balance sheet may be presented as either a classified or a liquidity-based balance sheet.

2. Current and Non-Current Classification

In this format, assets are separated into current assets and non-current assets. Similarly, liabilities are separated into current liabilities and non-current liabilities. Both IFRS and U.S. GAAP require this format.

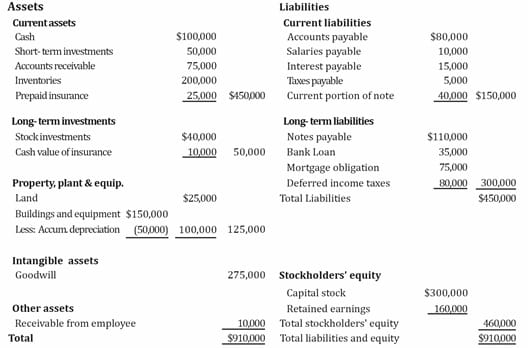

Example:

3. Liquidity-Based Presentation

In this format, the assets and liabilities are presented in a decreasing order of liquidity. This method is often used in the banking industry. Only IFRS permits this method.

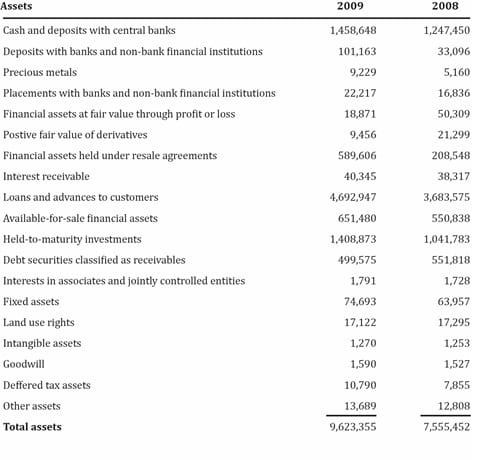

Example:

4 & 5. Current Assets

Current assets are those assets that are expected to be used up or converted to cash within one year or in one operating business cycle, whichever is greater. When the entity’s normal operating cycle cannot be clearly identifiable, its duration is assumed to be one year.

A few examples of current assets are:

- Cash and Cash Equivalents – Highly liquid, low-risk securities with maturity less than 90 days. They are reported at either fair value or amortized cost.

- Accounts receivable – Amount owed to a company for goods and services sold. They are reported at net realizable value.

- Inventories – Items held for sale or to be used for manufacturing. Inventories are measured at the lower of cost or net realizable value under IFRS, and at the lower of cost or market under U.S. GAAP.

- Marketable securities – Liquid securities which are publically traded in market. For example, bonds and stocks.

6. Current Liabilities

Current liabilities are those liabilities which are expected to be settled within one year or in one operating business cycle, whichever is greater.

A few examples of current liabilities are:

- Accounts payable – Amount that a company owes to its vendors for goods/services purchased on credit.

- Financial liabilities – borrowings such as bank loans, notes payable, and commercial paper.

Any portions of long-term liabilities that are due within one year appear in the current liability section of the balance sheet.

- Income taxes payable – Taxes recognized in the income statement but have not yet been paid.

- Accrued expenses – Expenses that have been recognized on a company’s income statement but which have not yet been paid as of the balance sheet date.

- Unearned revenue – Revenue for which cash has been collected but goods or services are yet to be provided. For example, receipt of advance rent payments, will fall under this category.

Share on :