IFT Notes for Level I CFA® Program

LM06 Fundamentals of Credit Analysis

Part 1

1. Introduction

This reading covers the basic principles of credit analysis, explores the relationship between the credit risk and capital structure of the firm, the role of credit rating in debt markets, and the impact of credit spreads on risk and return.

2. Credit Risk

Credit risk is the risk that the borrower will fail to make principal and/or interest payments on time. Credit risk has two components:

- Default risk or default probability: The borrower may fail to pay the full amount or a partial amount. The risk that the issuer fails to meet its obligation of making interest and principal payments on time is called default risk.

- Loss severity or loss given default: How severe is the loss incurred by the investor. What portion of the bond’s value (including interest) is not paid by the issuer. A default leads to various severity of losses; for instance, the loss may be total, or the bondholders may recover some value.

We combine both the components into a single term called the expected loss.

Expected Loss = Default probability x Loss severity given default

Loss severity = 1 – Recovery rate

Loss severity is expressed either as a monetary amount or as a percentage of the principal. Expressing it as a percentage is more useful as it is independent of the invested amount.

The recovery rate is the percentage of principal amount recovered in the event of a default.

Important credit-related risks include:

- Spread risk: Corporate bonds are usually quoted as a spread (yield premium) over risk-free bonds such as U.S. treasury bonds. The amount of spread is quoted in basis points. Assume the spread was initially 200 basis points, but has now increased to 250 basis points. This widening may be because of two factors: (1) factors specific to the issuer such as downgrade risk and (2) factors associated with the market as a whole such as an increase in market liquidity risk.

- Downgrade risk: It is the decline in an issuer’s creditworthiness, which makes investors believe that the risk of default is higher. This results in widening of yield spread on the issuer’s bonds to widen and its bond prices to fall. It is also known as credit migration risk.

- Market liquidity risk: This is the risk that the price at which investors can buy or sell may differ from the market price. A higher liquidity risk implies that it is more difficult for investors to transact (buy/sell) at a fair price. This happens when dealers show little interest in buying/selling bonds. The ability and willingness of dealers to make markets is reflected in the bid-ask spread. If the market liquidity risk is high, the bid-ask spread is wide.

Two issuer-specific factors that affect market liquidity risk are:

- The size of the issuer (large size means more debt is traded and market liquidity risk is low).

- The credit quality of an issuer. The lower the quality, the higher the risk.

3. Capital Structure, Seniority Ranking, and Recovery Rates

3.1. Capital Structure

Capital structure refers to the way a firm finances its assets across operating units. In short, it refers to the composition of equity (common share, preferred share) and debt (bank debt, bonds of all seniority rankings) across its operating units.

Assume a company has a total capital of $100 million of which bank debt is $5 million, bonds are $35 million, preferred shares are worth $10 million, and common equity accounts for $50 million. This is a simple capital structure. You may also have complicated capital structures with a holding company with multiple subsidiaries underneath it across geographies issuing their own debt with different seniority ranking.

3.2. Seniority Ranking

A single borrower may issue debt with different maturity dates and coupons. These various bond issues may also have different seniority rankings. Seniority ranking determines who gets paid first, or who has the first claim on the cash flows of the issuer, in the event of default/bankruptcy/restructuring. Bondholders are broadly classified into secured and unsecured.

- Unsecured bonds are known as debentures. They have a general claim on an issuer’s assets and cash flows.

- Secured bondholders have the first (direct) claim on cash flows in the event of a default.

- Priority of claims determines who gets paid first.

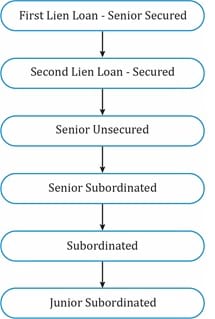

The exhibit below shows seniority ranking.

Within each category of debt, there are types and sub-rankings. Let us look at each of the items in detail now (in the order of priority for repayment):

Secured debt: Highest ranked debt in which some asset is pledged as collateral.

- First mortgage debt: A specific property is pledged.

- First lien debt: A pledge of certain assets such as buildings, patents, brands, property, and equipment, etc.

- Second lien or third lien: Some more assets could be pledged as a second or third lien to rank below the first mortgage/first lien.

Unsecured debt (in the order of ranking): Loss severity can be as high as 100%. Lowest priority of claims. No asset is pledged as collateral. The types are:

- Senior unsecured

- Subordinated

- Junior subordinated

Companies issue debt with different ranking for the following reasons:

- Cost effective: Secured debt has a lower cost due to reduced credit risk.

- Less expensive than equity: From a borrower’s perspective, even though the cost of issuing subordinate debt may not be as low as secured debt, it is less restrictive and is relatively less expensive than equity.

- Investors invest in subordinated debt because the higher yield compensates the high risk assumed.

3.3. Recovery Rates

Recovery rate is the percentage of the principal amount recovered in the event of default. Key points related to recovery rates are given below:

- Pari passu: All creditors at the same level of capital structure fall under the same class, and they will have the same recovery rates. For example, assume there are two creditors in the senior secured class; one with a 3-year bond and the other with a 1-year bond. The debt of the 1-year bondholder matures in 3 months while the debt of the 3-year bondholder matures in 2.5 years. If there is a default, both the investors will have the same recovery rates irrespective of the time left to maturity. This type of equal ranking for the same class of bonds is called pari passu (on equal footing).

- Recovery rates vary by seniority ranking: If the seniority ranking is high, recovery rate will also be high.

- Recovery rates vary by industry: If the industry is on a decline like the newspaper publishing industry, then the recovery rates will be low. There may be companies going bankrupt in industries during a recession (e.g., the steel industry in 2011-12), but in general the recovery rates here are higher than those on a decline.

- Recovery rates depend on when they occur in a credit cycle: For instance, if a default happened in 2008 at the peak of the recent credit crisis, then the recovery rates would have been lower relative to, let us say, in 2004-05.

- Recovery rates vary across industries and across companies within an industry.

- Priority of claims is not always absolute:

- Secured holders have a claim to cash flows/asset in the event of a default before anyone else. However, if the value of the pledged asset is less than the claim, then the unpaid amount becomes the senior unsecured claim.

- Unsecured creditors have a right to be paid before common/preferred shareholders.

- Senior creditors take priority over junior/subordinated creditors.

4. Rating Agencies, Credit Ratings, and Their Role in Debt Markets

Moody’s, S&P, and Fitch are the three main rating agencies. At least two of these agencies assign a rating to the majority of the bonds. The credibility/dominance of the rating agencies is because of:

- Their independent assessment of credit risk.

- Ease of comparison across bond issuers and issues.

- Regulatory and statutory reliance and usage.

- Issuer payment for ratings: This is controversial as some believe the rating may be biased as it creates a conflict of interest between the issuer, investor, and the rating agency.

- Growth of debt markets.

4.1. Credit Ratings

Be familiar with what the ratings are (Aaa represents the highest quality among investment grade securities, etc.). The rating system is almost similar across agencies starting from A for investment grade to C/D for junk.

Long-Term Ratings Matrix: Investment Grade vs. Non-Investment Grade

| |

|

Moody’s |

S&P |

Fitch |

|

Investment Grade |

High-Quality Grade

|

Aaa |

AAA |

AAA |

| Aa1 |

AA+ |

AA+ |

| Aa2 |

AA |

AA |

| Aa3 |

AA- |

AA- |

| Upper-Medium Grade

|

A1 |

A+ |

A+ |

| A2 |

A |

A |

| A3 |

A- |

A- |

| Low-Medium Grade |

Baa1 |

BBB+ |

BBB+ |

| Baa2 |

BBB |

BBB |

| Baa3 |

BBB- |

BBB- |

| |

|

Moody’s |

S&P |

Fitch |

|

Non-Investment Grade “Junk” or “High Yield” |

Low Grade or Speculative Grade

|

Ba1 |

BB+ |

BB+ |

| Ba2 |

BB |

BB |

| Ba2 |

BB- |

BB- |

| B1 |

B+ |

B+ |

| B2 |

B |

B |

| B3 |

B- |

B- |

| Caa1 |

CCC+ |

CCC+ |

| Caa2 |

CCC |

CCC |

| Caa3 |

CCC- |

CCC- |

| Ca |

CC |

CC |

| C |

C |

C |

| Default |

C |

D |

D |

Source: CFA Program Curriculum, Fundamentals of Credit Analysis

- Bonds rated AAA/Aaa have the highest quality, lowest credit risk, and lowest probability of default. They have extremely low default rates.

- Bonds rated Baa3/BBB- or higher are investment grade bonds. Investment grade is further divided into high-quality, upper-medium and low-medium.

- Bonds rated lower than Baa3/BBB- are non-investment grade bonds. Non-investment grade includes speculative and default bonds. These have higher default risk.

- Outlook: This is an additional indicator on a rating. The outlook can be positive, stable, or negative.

- The rating agencies may also indicate the potential direction of the ratings by including comments like “on review for a downgrade” or “on credit watch for an upgrade.”

Note: “Investment-grade ratings focus more on timeliness, while non-investment grade ratings give more weight to recovery”.

4.2. Issuer vs. Issue Ratings

Rating agencies provide two ratings:

- Issuer rating: This is based on the creditworthiness of the issuer. It applies to senior unsecured debt. Also known as corporate family rating (CFR).

- Issue rating: This rating is assigned to a specific debt/financial obligation. It takes into consideration the seniority ranking of the debt within the capital structure. Also known as corporate credit rating (CCR).

Cross-default provision: It is believed that the probability of default on one issue is linked to other issues of the same issuer. That is, a default on one issue triggers default on other issues with the same default probability.

Notching: A rating methodology to distinguish rating between different liabilities (bond issues) of an issuer. The objective is that two securities with the same rating should have the same expected loss rate (probability of default * expected severity loss). Credit rating on issues can be moved up or down by a notch based on the risk of default/severity loss.

Factors the rating agencies consider while assigning ratings (notching up/down):

- Probability of default: it is the primary factor that drives the rating.

- Priority of payment: who gets paid first in the event of a default; secured/senior unsecured/subordinated?

- Structural subordination: this is when the issuer is a holding company rather than an operating company. Assume both the holding company and each of its operating subsidiaries has issued bonds. The debt of the subsidiaries gets serviced by its cash flows and assets first before any of it can be passed on to the holding company. All else equal, debt issued by the holding company will have a lower rating than the debt issued by the subsidiary.

4.3 ESG Ratings

ESG investing involves making investing decisions based on:

- Environmental themes, such as investing in companies that: follow sustainable practices, try to reduce carbon emissions, or try to achieve other environmental agendas.

- Social themes, such as investing in companies committed to a diverse and inclusive workplace, minimizing salary gap, and community involvement programs.

- Governance themes, such as investing in companies committed to diverse board composition and strong oversight.

Rating agencies have started incorporating ESG factors into their ratings of firms. For example, MSCI Inc has launched a set of ratings that aim to measure a company’s attitudes, practices, and advances related to ESG. They identify and track leaders and laggards in the space. Companies are assessed according to their exposure to ESG risks and how well they manage those risks as compared to their peers. The leaders receive a higher rating such as AAA or AA, while the laggards receive a lower rating such as B or CCC.

4.4 Risks in Relying on Agency Ratings

There is sufficient evidence that rating agencies, in general, have done a good job of assigning ratings that reflect the risks involved. Investors rely on these ratings to assess the credit risk of their investments. However, these ratings are not foolproof and have their own limitations:

- Credit ratings can be very dynamic: Credit rating of a bond issue may change over time. For instance, a bond may have had “AAA” rating when it was issued. But five years later, it may be A. There have been instances where an “AAA” rated bond at issuance has turned into non-investment grade or junk within three years.

- Rating agencies are not infallible: The high ratings on subprime-backed mortgage securities are the best example of this. If the rating agencies had rated the issue appropriate to their risk level, it would have made investors cautious.

- Idiosyncratic or event risks are difficult to capture in ratings: Rating agencies do a poor job of foreseeing event risks because it is not possible and these cannot be reflected in a credit rating. A recent example is of the March 2011 tsunami that hit Japan, which in turn affected the credit risk of Tokyo Electric Power Company.

- Ratings tend to lag market pricing of credit: Bond prices move on a daily basis based on the perceived credit risk in them, as the market sees it. But, rating agencies do not revise their ratings that often. Investors who time their buy/sell decisions solely on the ratings issued by agencies are at the risk of underperforming the market. But a sudden downgrade has a disastrous effect on bond prices.

5. Traditional Credit Analysis: Corporate Debt Securities

5.1. Credit Analysis vs. Equity Analysis: Similarities and Differences

In many ways, credit analysis may look similar to equity analysis, but there are some important differences:

| Credit Analysis vs. Equity Analysis |

| Credit Analysis |

Equity Analysis |

| Analysis focuses on the downside risk: is the cash flow sustainable? Will the company be able to pay interest and principal? |

The focus is on analyzing the growth potential of a company (increase in EPS); how shareholder value will be maximized. How the company fares against its peers in the industry. |

| Management has a legal obligation to its bondholders. |

Maximizing shareholder value is the objective of management. |

| Analysts focus on balance sheet and cash flow statements. How much of total capital is debt and what is the seniority ranking of debt? |

Analysts focus more on income and cash flow statements. |

| Bondholders do not participate in the growth of a company but have limited downside risk in the event of a default. |

Shareholders have unlimited upside, but are more exposed to loss. They stand to lose their investment entirety before bondholders suffer a loss. |

5.2. The Four Cs of Credit Analysis: A Useful Framework

The four Cs of credit analysis framework are:

- Capacity: The ability of the borrower to make interest and principal payments on time over the term of the debt.

- Collateral: Quality and value of the assets pledged as collateral against the debt.

- Covenants: Terms and conditions of the agreement that the issuer must comply with.

- Character: Refers to the quality of the management. What is the financial history of the issuer; has it defaulted on payments in the past, or has there been a case of bankruptcy?

We will now look at each of the four Cs in detail.

Capacity

Capacity is the ability of a borrower to generate enough cash flows to service its debt. To determine an issuer’s capacity in credit analysis, you can draw a parallel to the top-down analysis in equity analysis. The steps involved are:

- Industry structure

- Industry fundamentals

- Company fundamentals

- Competitive position

Industry Structure

Let us begin by analyzing the industry structure using Porter’s five forces framework.

- Bargaining power of suppliers: Industries with few suppliers have greater credit risk. Fewer suppliers → limited negotiating power → customers have no control over frequent price raise.

- Bargaining power of buyers/customers: Industries with few buyers have greater credit risk. Buyers have negotiating power.

- Barriers to entry: High barriers to entry have lower risk as competition is low and pricing power is strong. Examples of high barriers to entry: high capital investment (aerospace), large distribution systems (auto dealerships), high degree of regulation (power plants, utilities).

- Substitution risk: Industries that offer products/services with great value and poor substitutes have low credit risk and strong pricing power. Ex: jet airplanes.

- Level of competition: Highly competitive industries have less predictable cash flow and higher credit risk. Ex: utilities, telecom companies.

Another factor to look at is the degree of operating leverage (DOL) in an industry/companies within the industry. If DOL is high, then fixed costs are high. If fixed costs are high, then as long as revenue is good, cash flows/profitability will be good.

The next step is to assess the industry’s fundamentals. What are its growth prospects? Does it get affected by macroeconomic factors? Etc.

Industry Fundamentals

The capacity to pay is influenced by company fundamentals. Some of the key points in this regard are given below:

- Cyclical or non-cyclical: Cyclical companies are affected by economic downturns. Their revenues and cash flows are impacted adversely during a recession. If a company is in a cyclical industry, then the level of debt must be low. Example: demand for steel fell drastically following the recent credit crisis and slowdown in Europe. On the contrary, non-cyclical companies in pharmaceutical and consumer products industries outperformed during this period.

- Growth prospects: Should credit analysts analyze growth prospects like equity analysts do? Yes to an extent, as weaker companies may struggle to sustain themselves financially in slow-growth industries unless they merge with another company, or are acquired by a larger company.

- Published industry statistics: Statistics published by rating agencies or government agencies are a good source of information for credit analysts to get a sense of how the industry is performing.

Company Fundamentals

Analysts must consider the following factors while evaluating a company’s fundamentals:

- Competitive position: What is the company’s market share – is it increasing/decreasing? Is the company competitive within its industry? How is its cost structure relative to its peers?

- Track record/operating history: How has the company performed over time through different economic cycles? How does the balance sheet look like (debt vs. equity)? How is the performance of the current management team?

- Management’s strategy/execution: What is the management’s strategy; to grow and to compete? Is it too aggressive relative to its peers? Is it venturing into unrelated businesses? How does it plan to finance its strategy?

- Ratios and ratio analysis: Ratio analysis is used to assess a company’s financial health at any point in time, its performance over time, and how competitive it is relative to its peers. Credit analysts calculate a number of ratios. Here, they are categorized into the following three groups:

- Profitability and cash flow: This is important to see if a company is profitable and generates enough cash flows to make interest/principal payments on time.

- Coverage: Measures an issuer’s ability to meet its interest payments.

- Liquidity is another measure that analysts look at as high liquidity means lower credit risk.

Key ratios used in credit analysis are:

Profitability ratios:

- Refers to operating income and operating profit margin. Operating income is typically defined as earnings before interest and taxes.

- A higher profitability ratio indicates lower credit risk.

Cash flow measures: Cash flow is measured as

- Earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Funds from operations (FFO).

- Free cash flow before dividends.

- Free cash flow after dividends.

A high cash flow indicates lower credit risk.

Leverage ratios: Includes

- Debt-to-capital ratio.

- Debt-to-EBITDA ratio.

- FFO-to-debt ratio.

Lower leverage indicates lower credit risk.

Coverage ratios: Includes

- EBIT-to-interest expense ratio.

- EBITDA-to-interest expense ratio.

Higher coverage ratios indicate lower credit risk.

Collateral

The objective of collateral analysis is to assess the value of the assets relative to the amount of debt issued by a company. Credit analysts consider the collateral value if the probability of default is too high.

Methods used by analysts to determine the quality and value of a company’s assets are discussed below:

- One of the ways to calculate the quality of a publicly traded company’s assets is equity market capitalization. For instance, if the company’s stock is trading below its book value, then the quality of its assets is low.

- If capital expenditure is less than depreciation expense, then the quality of assets may be low as the company is not investing enough in its business.

- How many intangible assets (patents/goodwill) does the company have on its balance sheet? Patents are valuable and may be sold.

Collateral value is insignificant for companies with primarily human and intellectual capital (e.g., software and investment management firms) as they do not have hard assets.

Covenants

Instructor’s Note:

This was discussed in detail in the introductory Fixed-Income Securities reading.

Covenants are clauses that state what an issuer can and cannot do. Bond covenants are legally enforceable rules that borrowers and lenders agree on at the time of a new bond issue. They are described in the bond prospectus. There are two types of covenants: affirmative (positive) or negative (restrictive).

Affirmative covenants

- Indicate what the issuer must (is obligated to) do.

- Examples: Make interest and principal payments on time, comply with all laws and regulations.

Negative covenants

- Indicate what the issuer must not do.

- Examples: Restrictions on debt, limits on maximum acceptable leverage ratios and minimum acceptable interest coverage ratios, negative pledges such as no additional debt can be issued that is senior to existing debt.

Character

Nowadays, most companies are publicly owned, instead of by individuals. Judging the character of a management is different than it would be for an owner-managed firm.

- How sound is the management’s strategy for growth of the company?

- How successful was the management in executing strategies in the past?

- Are the accounting/tax policies too aggressive?

- Is there any history of fraud?

Share on :