IFT Notes for Level I CFA® Program

LM11 Financial Reporting Quality

Part 3

8. Detection of Financial Reporting Quality Issues: Introduction & Presentation Choices

Analysts must be able to understand the choices that companies make in financial reporting while evaluating the overall quality of reports – both financial reporting quality and earnings quality. There is no right or wrong choice. The intent of the management is what makes the difference.

Choices exist both in how information is presented (financial reporting quality) and in how financial results are calculated (earnings quality).

- Choices in presentation are often transparent.

- Choices in the calculation of financial results are more difficult to detect.

Ways to increase performance and financial position in the reporting period include the following:

- Recognize revenue prematurely. Ex: a software services company recognizes revenue before the services are delivered to a client. Revenue and earnings will be overstated in the current period.

- Use non-recurring transactions to increase profits. Ex: selling accounts receivable, which increases earnings in an unsustainable manner.

- Defer expense to later periods. Ex: warranty expense for a sale that happened in this period should be recognized now and not put off for later. Deferring understates expense.

- Measure and report assets at higher values; and/or

- Measure and report liabilities at lower values. Equity will be overstated if assets are higher and liabilities are lower.

Ways to increase performance and financial position in a later period include the following:

- Defer current income to a later period (save income for a rainy day); and/or

- Recognize future expenses in a current period; setting the table for improving future performance. Ex: cookie jar reserve accounting. Higher expenses are reported in the current period. This allows earnings in the later period to be overstated because lower expenses are reported later.

8.1 Presentation Choices

- Companies may use “strange new metrics”. Metrics are set by a company or an industry, and not by a standard-setting body. For example, website companies started using metrics such as “eyeballs” or “stickiness” to measure user engagement and operating performance; traditional valuation methods such as P/E could not justify their stock prices.

- Companies may present “pro forma earnings”. These are earnings that are not prepared in accordance with any standard such as US GAAP or IFRS. Analysts must be careful about the assumptions made in the financial reports as they may be manipulated to make the earnings look better. Ex: companies would exclude huge restructuring charges (to the tune of $3-$7 billion) in performance presentation to make earnings look good to investors.

- EBITDA is earnings before interest, taxes, depreciation, and amortization. It is often used as a proxy for operating cash flow. EBITDA is used to compare companies as the expense incurred for depreciation, amortization, and restructuring may vary with the choice of accounting method. Companies may construct their own version of EBITDA by excluding the following from net income:

- Rental payments for operating leases.

- Equity-based compensation, usually justified on the grounds that it is a non-cash expense.

- Acquisition-related charges.

- Impairment charges for goodwill or other intangible assets.

- Impairment charges for long-lived assets.

- Litigation costs.

- Loss/gain on debt extinguishments.

- If companies are compared using EBITDA measure, then it must be ensured that the companies calculate EBITDA in a similar manner and the same assumptions are made.

- IFRS requires a definition and explanation of any non-IFRS measures included in financial reports.

- Similarly, if a company uses a non-GAAP financial measure, then it must also include the closest GAAP measure with prominence. It must also explain why the non-GAAP measure is a better choice to represent the company’s financial condition than the GAAP measure.

9 – 11. Accounting Choices and Estimates and Their Effects

In this section, we look at the accounting methods (choices and estimates) made by the management for a desired outcome such as earnings growth or meeting the numbers.

How Choices Affect the Cash Flow Statement

A cash flow statement has three sections:

- Cash flow from operations (CFO): This is of most interest to investors. The CFO is insulated from manipulation more than the income statement. For instance, if a large part of the earnings is from accruals, then it should raise a red flag.

- Cash flow from investing (CFI)

- Cash flow from financing (CFF)

How the cash flow statement is manipulated:

- Misclassification of cash flows: Analyze the composition of CFO closely. For example, if a certain cash outflow should be classified as part of CFO but is instead shown as CFI, or if a cash inflow must be part of CFI but shown as CFO, then it indicates manipulation.

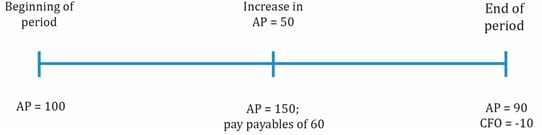

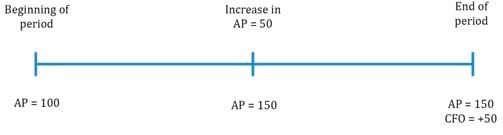

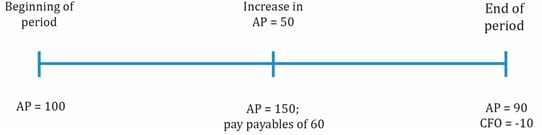

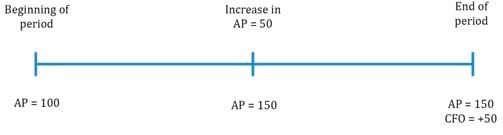

- Payables management: Decrease in accounts payables is a use of cash. Consider the following:

- At the end of the period, the payables decrease to 90 which is a decrease in the liability. It is the use of cash and decrease in CFO. Contrast this with the following if a company wanted to manipulate the CFO. It could delay the payable by stretching the credit period, which will increase the CFO by +50.

- Interest capitalization: This is due to the differences between interest payments and interest costs. Assume a company takes a loan to construct a factory. It pays an interest of 100,000 in a given period of which 70,000 is the interest expense (on the income statement) and 30,000 is capitalized interest on the loan taken. The amount that will show up as interest in CFO will be 70,000 and 30,000 in CFI.

- Flexibility in the classification of interest/dividends paid and received: Interest paid and interest/dividends received may be classified as operating cash flow. Or interest paid can be classified as a financing cash flow and interest/dividends received can be classified as investing cash flows. Dividend paid may be classified as a financing cash flow or cash flow from operating activities.

Analysts should:

- Examine the composition of the operations segment.

- Compare company’s cash generation with other companies in the industry; study relationship between net income and CFO.

Share on :