IFT Notes for Level I CFA® Program

LM04 Understanding Balance Sheets

Part 3

13. Components of Equity

Equity is the owners’ residual claim on a company’s assets after subtracting its liabilities.

The six components of equity are:

- Contributed capital: Total amount paid in by common and preferred shareholders.

- Treasury shares: These are shares that have been repurchased by the company, but not yet retired.

- Retained earnings: Cumulative income of firm since inception that has not been distributed as dividends.

- Accumulated other comprehensive income: These include items which lead to changes in equity but are not part of the income statement or from issuing stock, reacquiring stock, and paying dividends.

- Non-controlling interest (minority interest): It is the portion of a subsidiary not owned by the parent company. For example, if a firm owns 80% of a subsidiary, then it will report 20% of net assets of the subsidiary as minority interest.

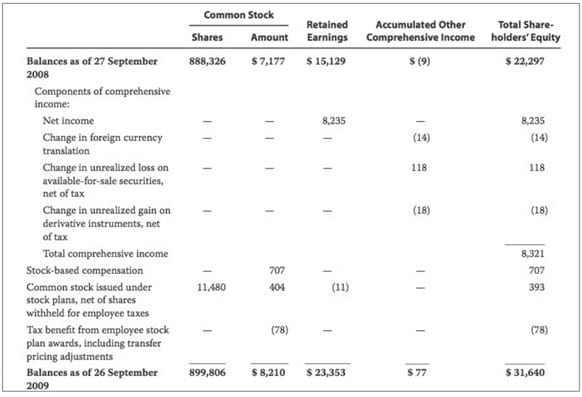

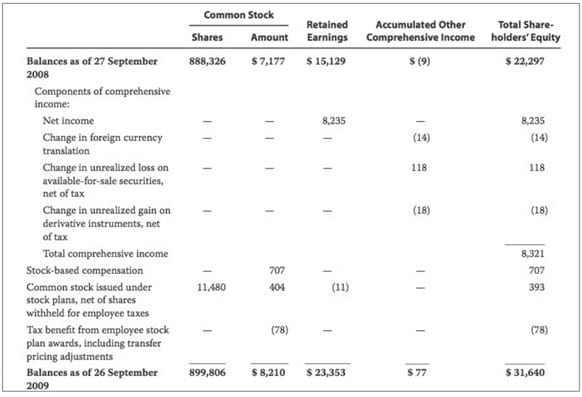

14. Statement of Changes in Equity

The statement of changes in equity presents information about the increases or decreases in a company’s equity over a period of time. IFRS requires the following information in the statement of changes in equity:

- total comprehensive income for the period;

- the effects of any accounting changes that have been retrospectively applied to previous periods;

- capital transactions with owners and distributions to owners; and

- reconciliation of the carrying amounts of each component of equity at the beginning and end of the year.

U.S. GAAP requirement is for companies to provide an analysis of changes in each component of equity as shown in the balance sheet.

Sample Statement of Changes in Stockholders’ Equity

Share on :