101 Concepts for the Level I Exam

Concept 65: Minimum-Variance and Efficient Frontiers

![]()

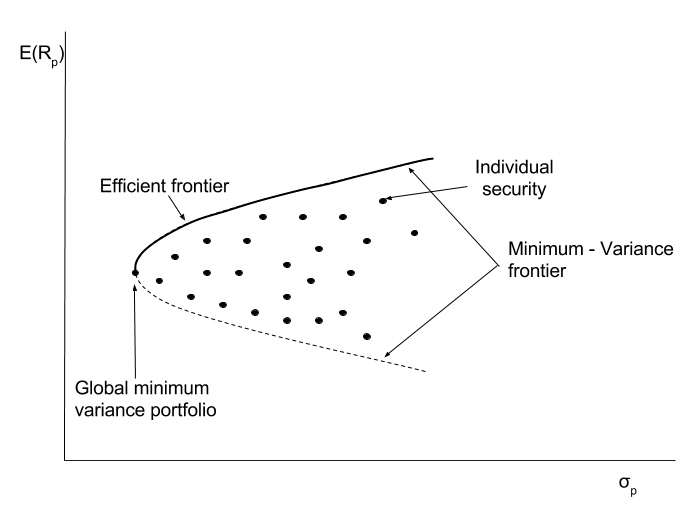

- Investment opportunity set: Portfolios with varying weights of all the individual assets (both risky assets and risk free assets) available to the investors are plotted on a graph where return is on the y-axis and standard deviation (risk) is on the x-axis.

- For a given rate of return, there will be a portfolio with minimum variance (risk) available in the opportunity set. The curve connecting such portfolios with minimum variance is called the minimum-variance frontier.

- The portfolio having the least risk (variance) among all the portfolios of risky assets is called the global minimum-variance portfolio.

- As a risk averse investor will only select the portfolio giving higher return for a given level of risk, the part of minimum-variance frontier above the global minimum-variance portfolio is called the efficient frontier.

The graph below shows these points:

Share on :