101 Concepts for the Level I Exam

Concept 48: Liquidity and Solvency Ratios

![]()

Liquidity ratios measure a company’s ability to meet current liabilities. The higher the liquidity ratio, the more likely the firm will be able to meet its short term obligations.

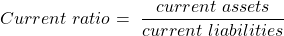

- Current ratio – It is the most widely used measure of liquidity.

Current ratio = current assets / current liabilities

- Quick ratio – It is a more conservative measure of liquidity. It excludes inventories and less liquid assets from the numerator

![Rendered by QuickLaTeX.com ]$$Quick\ ratio=\ {{cash+marketable\ securities+receivables}\over {current\ liabilities}}$$](https://ift.world/wp-content/ql-cache/quicklatex.com-66d22ebb17501c9c33a82698acc4058f_l3.png)

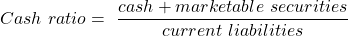

- Cash ratio – It is the most conservative measure of liquidity. Even receivables are excluded from the numerator.

Solvency ratios measure a company’s ability to meet long-term obligations. A high ratio indicates high leverage and a high financial risk.

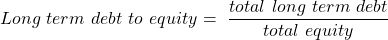

- Long term debt to equity ratio — It measures long term financing sources relative to total equity.

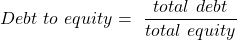

- Debt to equity ratio– It measures total debt relative to total equity.

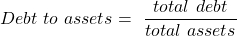

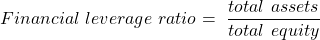

- Total debt to assets ratio – It measures the extent to which assets are financed by liabilities.

- Financial leverage ratio – It measures total assets relative to total equity.

Share on :

![]()

![Rendered by QuickLaTeX.com ]$$Quick\ ratio=\ {{cash+marketable\ securities+receivables}\over {current\ liabilities}}$$](https://ift.world/wp-content/ql-cache/quicklatex.com-66d22ebb17501c9c33a82698acc4058f_l3.png)

![]()

![]()

![]()

![]()

![]()