We use the following table to decide which test statistic and which corresponding probability distribution to use for hypothesis testing.

| Sampling from | Small sample size | Large sample size | |

| Normal distribution | Variance known | z | z |

| Variance unknown | t | t (or z) | |

| Non–normal distribution | Variance known | NA | z |

| Variance unknown | NA | t (or z) | |

You believe that the average returns of all stocks in the S&P 500 is greater than 10%. You draw a sample of 49 stocks. The average return of these 49 stocks is 12%. The standard deviation of returns of all stocks in the S&P 500 is 4%. Using a 5% level of significance, determine if your belief is correct.

Solution:

Step 1: State the hypothesis

H0: µ ≤ 10%

Ha: µ > 10%

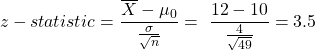

Step 2: Calculate the test statistic

The population variance is known hence we will use z-statistic.

Step 3: Calculate the critical value

This is a one-tailed test and we will be looking at the right tail. Using the Z –table and 5% level of significance

Critical value = Z0.05 = 1.65

Step 4: Decision

Since the test statistic (3.5) > critical value (1.65), we reject H0. Hence at 5% level of significance, your belief that the average returns of all stocks in the S&P 500 is greater than 10% is correct.

You believe that the average returns of all stocks in the S&P 500 is greater than 10%. You draw a sample of 25 stocks. The average return of these 25 stocks is 12% and the standard deviation of their returns is 7%. Using a 5% level of significance, determine if your belief is correct.

Solution:

Step 1: State the hypothesis

H0: µ ≤ 10%

Ha: µ > 10%

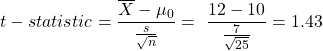

Step 2: Calculate the test statistic

The population variance is not known hence we will use t-statistic.

Step 3: Calculate the critical value

This is a one-tailed test and we will be looking at the right tail. Using the t –table and 5% level of significance and degrees of freedom = 25 -1 = 24

Critical value = t24,0.05= 1.71

Step 4: Decision

Since the test statistic (1.43) < critical value (1.71), we cannot reject H0. Hence at 5% level of significance, your belief that the average returns of all stocks in the S&P 500 is greater than 10% is incorrect.