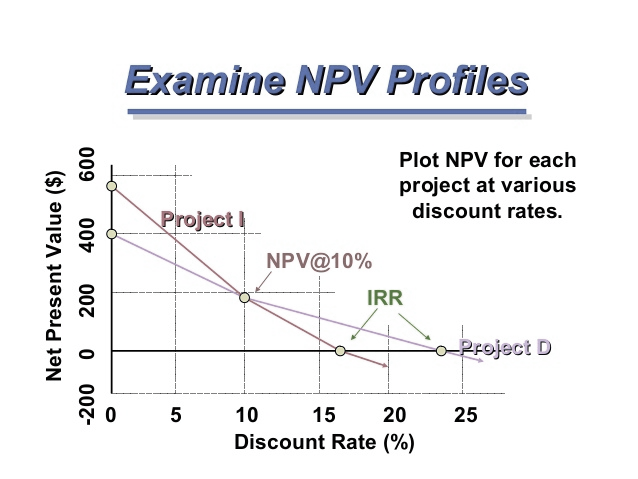

NPV profile shows the sensitivity of a project’s NPV for different discount rates. It is plotted on a graph where NPVs are on the y-axis with the discount rates on the x-axis.

Comparison between NPV and IRR method

| NPV method | IRR method |

| Advantages:

· Direct measure of expected increase in value of the firm. · Produces theoretically correct decisions for unconventional cash flows. |

Advantages:

· Gives percentage return on each dollar invested. · Direct comparison with the cost of capital. |

| Disadvantages:

· Ignores project size. (Profitability Index overcomes this drawback.) |

Disadvantages:

· Conflicting rankings that are different from NPV analysis for mutually exclusive projects. (Choose the project with higher NPV.) · Projects with unconventional cash flow pattern can have multiple IRRs or no IRR. · Unrealistically assumes that the money is reinvested at IRR rates. |

For mutually exclusive projects, the NPV and IRR methods can have conflicting results due to the differences in project size or timings of cash flows. In such a case, always select project using NPV method. For independent projects, both NPV and IRR analysis yields the same decision.