101 Concepts for the Level I Exam

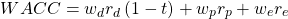

Concept 61: Weighted Average Cost of Capital (WACC)

![]()

- It is the overall cost of the sources of capital.

- Represents the required return or opportunity costs for the firm as a whole.

- It is the appropriate discount rate for cash flows of projects having similar risk profile as that of the firm.

- Has weights that are derived from target capital structure and market values of each source of capital.

- Is also called the marginal cost of capital (MCC)

A firm has the following capital structure: 20% debt, 10% preferred stock, and 70% equity. The before-tax cost of debt is 6%, cost of preferred stock is 8%, and cost of equity is 12%. The firm’s marginal tax rate is 30 percent. Calculate its WACC.

Solution:

The WACC can be calculated using the formula.

WACC = (0.2) (0.06) (1 – 0.3) + (0.1) (0.08) + (0.7) (0.12) = 10.04%

Share on :

![]()