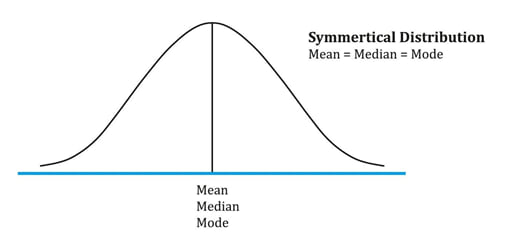

Symmetrical distribution

A distribution is said to be symmetrical when the distribution on either side of the mean is a mirror image of the other.

In a normal distribution, mean = median = mode.

If a distribution is non-symmetrical, it is said to be skewed. Skewness is a measure of the asymmetry of the probability distribution. Skewness can be negative or positive.

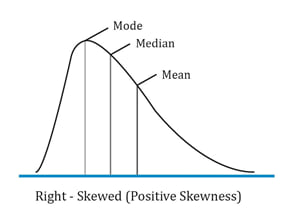

Positively skewed distribution

A positively skewed distribution has a long tail on the right side, which means that there will be limited but frequent downside returns and unlimited but less frequent upside returns.

Here the mean > median > mode. The extreme values affect the mean the most which is pulled to the right. They affect the mode the least.

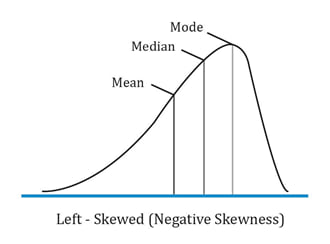

Negatively skewed distribution

A negatively skewed distribution has a long tail on the left side, which means that there will be limited but frequent upside returns and unlimited but less frequent downside returns.

Here the mean < median< mode. The extreme values affect the mean the most which is pulled to the left. They affect the mode the least.

Instructor’s Note: Investors prefer positive skewness because it has a higher chance of very large returns and also because it has a higher mean return.

Example:

Which of the following distribution is most likely characterized by frequent small losses and a few extreme gains?

Solution:

C is correct. A positively skewed distribution is characterized by frequent small losses and a few extreme gains.

Example:

Which of the following is most likely to be true for a negatively skewed distribution?

Solution:

A is correct. In a negatively skewed distribution, the mean < median < mode.

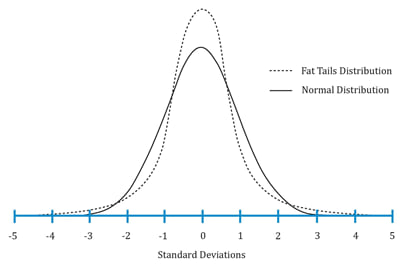

Kurtosis is a measure of the combined weight of the tails of a distribution relative to the rest of the distribution.

Excess kurtosis = kurtosis – 3. An excess kurtosis with an absolute value greater than one is considered significant.

The following figure shows a leptokurtic distribution. As compared to a normal distribution, a leptokurtic distribution is more likely to generate observations in the tail region. It is also more likely to generate observations near the mean. However, to have the total probabilities sum to 1, it will generate fewer observations in the remaining regions (i.e. regions between the central and the two tail regions)

Covariance

Covariance is a measure of how two variables move together. The formula for computing the sample covariance of X and Y is:

![]()

The problem with covariance is that it can vary from negative infinity to positive infinity which makes it difficult to interpret. To address this problem, we use another measure called correlation.

Correlation

Correlation is a standardized measure of the linear relationship between two variables with values ranging between -1 and +1.

The sample correlation coefficient can be calculated as:

![]()

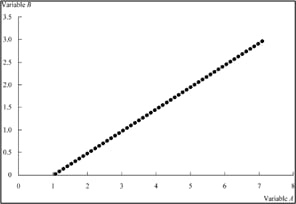

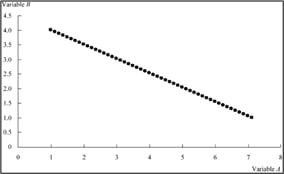

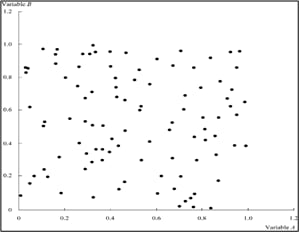

The three scatter plots below show a positive linear, negative linear, and no linear relation between two variables A and B. They have correlation coefficients of +1, -1 and 0 respectively.

Variables with a correlation of 1.

The correlation analysis has certain limitations: