Economics is a discipline that deals with factors affecting the production, distribution, and consumption of goods and services. It is divided into two broad areas: microeconomics and macroeconomics.

Macroeconomics deals with the production and consumption of the overall economy. It focuses on aggregate economic quantities such as gross domestic product, gross national income, and national output.

Microeconomics deals with demand and supply of goods and services at a micro level, such as individual consumers and businesses. According to microeconomics, private economic units can be divided into two groups of study:

This reading focuses on microeconomics and covers the demand and supply side of the market.

Demand is the willingness and ability of consumers to purchase a given amount of good or service at a given price. The law of demand states that as the price of a good rises, consumers will want to buy less of it. Similarly, as price falls, the quantity demanded increases. Apart from the good’s own price, other factors that impact consumer demand include prices of other substitute and complement goods, customers’ incomes, and individual tastes and preferences.

The general form of a demand function is shown below:

Demand function for good A: QD = f(PA, I, PB … … )

where:

QD = quantity demanded of some good.

I = consumer’s income.

PA = price per unit of a related good A.

PB = price per unit of a related good B.

Let us take a hypothetical example of a demand function for the quantity of chairs demanded in a small town. The demand function is given by:

QD = 10 – 0.5P + 0.06I – 0.01PT

In the equation above, I is the consumers’ income and PT is the price of tables. Note the signs of the coefficients for income and price of tables. Chairs and tables are complementary products as they sell together. The quantity demanded for chairs, QD, and price of tables, PT, are inversely related. If the price of a table increases, then the quantity demanded for chairs decreases. Similarly, income has a positive coefficient. If income increases, then the quantity demanded for chairs increases.

Now, let us assume that the consumers’ income and the price of the table are fixed at a particular point in time. If the values of I and PT are 1633.33 and 800.00 respectively, then the quantity demanded can be rewritten as:

QD = 100 – 0.5P

The inverse demand function expresses the simple demand function in terms of price. The above function can be rearranged and expressed in terms of P as:

P = 200 – 2Q

A demand curve is a graphical representation of the inverse demand function. The demand curve plots the price on the y-axis and the quantity on the x-axis. It shows the quantity of a good that consumers are willing to buy at any given price, all else equal.

Let us plot the demand curve given by the equation P = 200 – 2Q. Here, the intercept is 200 and the slope of the curve is -2. The slope of the demand curve is measured as the change in price divided by the change in quantity.

![]()

Interpretation of the graph:

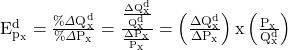

Own-price elasticity of demand can be expressed as the percentage change in quantity divided by the percentage change in price.

Before we go further, let us refresh a basic mathematical principle. Consider a simple equation:

A = 10 + 5B – 6C + 8D. Given this equation, is equal to the coefficient of B which is 5. Similarly, is equal to the coefficient of C which is -6.

Going back to our demand function, QD = 100 – 0.5P. Based on the mathematical principle we just discussed, ![]() = -0.5. Assume the price is $60; the quantity demanded at this price will be 70. The own-price elasticity of demand is: -0.5 x 60/70 = -0.4. This implies that when the price is $60, a 1% increase in price results in a 0.4% decrease in the quantity demanded for chairs.

= -0.5. Assume the price is $60; the quantity demanded at this price will be 70. The own-price elasticity of demand is: -0.5 x 60/70 = -0.4. This implies that when the price is $60, a 1% increase in price results in a 0.4% decrease in the quantity demanded for chairs.

Instructor’s Note

Own-price elasticity of demand is usually negative.

Elastic, Inelastic, and Unit Elastic

For all linear demand curves, elasticity varies depending on where it is calculated. Let us go back to the own-price elasticity of demand for chairs to see which parts of the demand curve are inelastic, elastic and unit elastic.

![]()

These scenarios are shown in the figure below:

Inference:

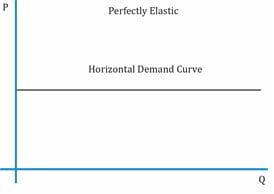

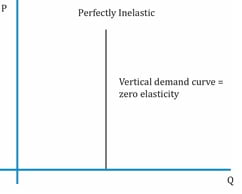

Extremes of Price Elasticity

There are two special cases of linear demand curves in which the elasticity is the same at all points – perfectly elastic and perfectly inelastic – though it is difficult to find real life examples. Demand is perfectly inelastic (represented by a vertical demand curve) when the quantity demanded is the same over a price range. Demand is perfectly elastic for a given price (represented by a horizontal demand curve) when a change in price will cause the quantity demanded to reduce to zero.

| Elasticity | |

| Perfectly Elastic | Perfectly Inelastic |

| Horizontal demand curve | Vertical demand curve. |

| Elasticity = ∞ | Elasticity = 0 |

| A small change in price can lead to infinitely large change in quantity. All producers must sell at the market price, or else consumers will shift to substitutes.

Example: Gourmet food items. |

A change in price has no change in quantity demanded.

Example: generic food such as bread. |

|

|

Factors that affect Demand Elasticity

The factors that help in determining whether the demand for a product is highly elastic are as follows:

Elasticity and Total Expenditure

Total expenditure is the total amount consumers spend on a product. It is the price multiplied by the quantity.

Total expenditure = P x Q = Price per unit x quantity or number of units sold

Elastic demand: When demand is elastic, a 1% decrease in price causes a quantity demanded to increase by more than 1%. As a result, total expenditure increases.

Inelastic demand: When demand is inelastic, a 1% decrease in price causes quantity demanded to increase by less than 1%. As a result, total expenditure decreases.

Unit elastic: Total expenditure does not change at the point where demand is unit elastic.

The relationship between change in price and total expenditure is summarized in the table below:

| Elasticity and Expenditure | |

| Own-price elasticity of demand = Total expenditure = P x Q = Price per unit x quantity or number of units sold |

|

| Ed > 1: elastic demand | Price and total expenditure move in opposite directions |

| Ed = 1: unitary elastic | Change in price has no effect on total expenditure |

| Ed < 1: inelastic demand | Price and total expenditure move in the same direction |