To value an option free bond, we can either use the sport rates or a binomial tree. Since both the methods are arbitrage free, the two values should be the same.

Consider an option-free bond with four years remaining to maturity, a coupon rate of 2%, and a par value of $100. Assume spot rates are as shown in Exhibit 3.

| Maturity (Years) | One-Year Spot Rate |

| 1 | 1.000% |

| 2 | 1.201% |

| 3 | 1.251% |

| 4 | 1.404% |

| 5 | 1.819% |

Then the bond value can be calculated as:

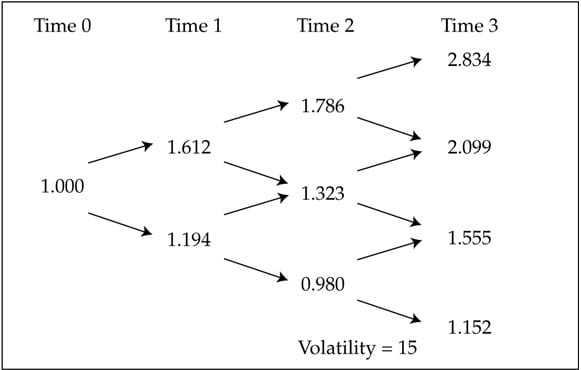

Next consider a binomial interest rate tree calibrated to the same spot curve (Exhibit 13).

We can then use the backward induction discounting process to obtain the bond value.

| Time 0 | Time 1 | Time 2 | Time 3 | Time 4 |

| 102.3254 | 102.6769 | 101.7639 | 101.1892 | 102 |

| 104.0204 | 102.8360 | 101.9027 | 102 | |

| 103.6417 | 102.4380 | 102 | ||

| 102.8382 | 102 | |||

| 102 |

The tree produces the same value for the bond as the spot rates and is therefore consistent with our standard valuation model.