101 Concepts for the Level I Exam

Essential Concept 80: The BSM Model

![]()

The inputs to the BSM model are:

- Price of underlying stock, S

- Continuously compounded risk-free rate, r

- Time to maturity in years, T

- Strike price, X

- Volatility of the underlying in annual percentage terms, σ

The BSM model for non-dividend paying stock is:

c = SN(d1) – e–rTXN(d2)

p = e–rTXN(–d2) – SN(–d1)

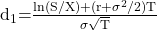

where:

Using the above inputs, the BSM model can be used to predict:

- Call option price, c

- Put option price, p

Instructor’s Note:

The following tips will help you remember the formulas.

c = SN(d1) – e–rTXN(d2)

p = e–rTXN(–d2) – SN(–d1)

- A call option is of the form S- X, whereas a put option is of the form X – S.

- The present value of strike price X is obtained by multiplying it by e–rT

- d1 is associated with S, whereas d2 is associated with X

- For call options we use positive values of d1 and d2. Whereas, for put options we use negative values of d1 and d2.

Share on :

![]()

![]()